10 Best Accounts Payable Software Tools For 2025

Managing your accounts payable process efficiently is vital to avoid late payments, reduce manual errors, and keep your business financially healthy. Accounts payable (AP) software helps automate the entire process—from receiving invoices to approval and payment—making it faster, more accurate, and easier to track.

In the UK, where timely vendor payments and compliance are crucial, choosing the right AP software can give you a major advantage. With features like automated invoice capture, multi-level approvals, and real-time reporting, these tools take the hassle out of managing supplier payments.

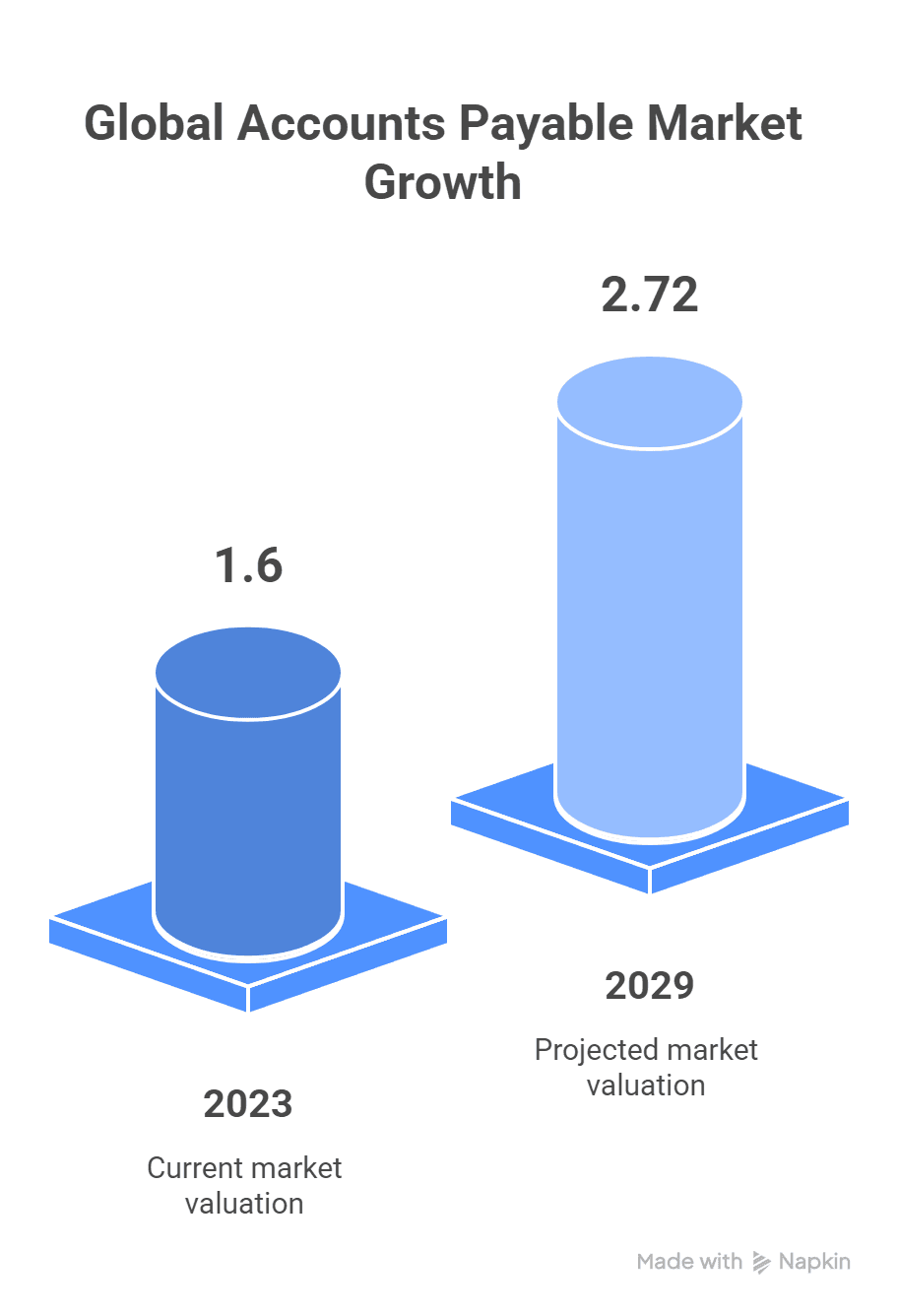

Accounts payable represent the short-term debts a business owes to suppliers. Manual handling of invoices often leads to delays, errors, and compliance risks. According to ResearchAndMarkets, the global Accounts Payable Market was valued at USD 1.6 billion in 2023 and is expected to reach USD 2.72 billion in 2029 and project robust growth in the forecast period with a CAGR of 9.1% through 2029.

What is Accounts Payable Software?

Accounts Payable software is the tool/solution used by the organisation to manage its AP processes and functions. The accounts payable automation software encompasses the entire workflow for the AP process cycle and includes all accounts payable activities, like tracking and processing the invoices to be paid to the suppliers or vendors.

Generally, the AP process involves functions like invoice verification, data entry, invoice scanning/payment processing, and vendor management. An accounts payable automation software automates these processes, reducing the need for manual intervention, thereby reducing costly human errors.

The accounts payable workflows document the current liabilities of the organisation and automate and optimise the spending and cash management of your organisation. The accounts payable management software enables organisations to streamline their AP processes, thereby improving their financial management with extensive reporting and analysis.

What is An Accounts Payable System?

Businesses of all sizes can make use of various software for accounts payable to control their financial activity with enhanced transparency and accuracy. Such environments that employ accounts payable software to manage the operations of the accounts payable department are referred to as the accounts payable system. Software for accounts payable can be a part of workflow management solutions already established in the organisation, like Cflow, while there are also other stand-alone options.

Discover why teams choose Cflow

The accounts payable process involves:

Data entry

Dedicated teams are bound to gather the required information from the invoices or other financial documents.

Reconciliation

Users are required to validate the information entered into their system by matching the two records, i.e. Records are being checked for any discrepancies.

Payment processing

Timely payments save future disputes/misunderstandings. Ensure actions to make payments before the due date.

Updation

Users make sure that the payments done/due are updated correctly in the system so that they reflect the correct debts/credits in the cash flow statement.

The accounting software then records the data by applying filtering, categorising/ matching, and validating the collected information, to make a cash flow statement of an organisation. Timely and accurate approvals are a must in the accounts payable process to avoid delays and business losses.

Make your payments/ debts cleared on time for your business relationship to be smooth and better, and streamline Accounts Payable processes.

The accounts payable in the company’s balance sheet show the sum of all outstanding payments incurred by the company and to be paid within a due date. The companies are likely to pay the debt as early as their due date as possible to avoid penalties and enjoy any discounts that may be offered for early settlements.

The accounts payable are referred to as outstanding/ debt in the company’s cash flow statement, while it is receivables in the supplier’s cash flow statement. The increase/decrease in accounts payable from the prior year manipulates the business cash flow. If accounts payable is increased, that means your business has bought more goods and services on credit compared to the previous year, and the decrease in accounts payable indicates that the debt settlement/ payment is initiated at a faster rate compared to purchases made on credit.

The accounts payable system is used by startups, SMEs, and large enterprises to streamline their financial processes and improve their efficiency. Usually, an AP process is managed by the accounting/finance team or whoever is responsible for the financial management in an organisation.

You can get started with Cflow for free

Why Automate Accounts Payable Processes?

The prime goal behind implementing accounts payable software is to facilitate seamless and efficient management of AP transactions, and automating the process saves you time and money.

Accounts payable automation software allows you to streamline the complex accounts payable workflows, imparting ways to achieve several other worthy goals, that impact the business bottom line apart from the specific purpose of managing accounts/financial transactions.

Automating accounts payable systems aids you in streamlining vendor payments, tracking expenses, and maintaining accurate financial records while adhering to internal budgetary constraints and compliance on both ends.

Any delayed payments will attract unwanted fines/ disputes with the suppliers. The accounts payable software keeps track of the due date and notifies the intended persons/team about the due date while highlighting the early discounts applicable, if any. Therefore, automating the accounts payable system is required to avoid such scenarios, benefiting the organisations by reducing the penalties or the chance of getting penalised.

The accounts payable systems are employed by any organisation to have control over their finance or cash flow so that they can act proactively towards the payments/settlements in the near future to the vendors, and also can anticipate any other cost-saving measures.

The insights are so intuitive in accounts payable management software that an organisation using one can make decisions on spending and expenses. The reports produced by the accounts payable automation software have a complete record of the cash flow over a particular period of time. Organisations analyse these reports quarterly or yearly and compare them to come up with decisions on cash ebbs and flows for the future.

In essence, the right automation tool for accounts payable management continues to improve finance control and develop advanced accounting practices while reducing the burden on accounting professionals.

Key Features of an Accounts Payable Software

- The accounts payable software aids you in keeping track of your financial management, facilitating a channel to clear all the debts/ outstanding vendor payments in an efficient manner. You can’t disagree that there are numerous stand-alone accounting software/tools in the market to do the job. But the real deal is choosing the right fit with the best features for your organisation.

- The best accounts payable solution should also offer significant accounts payable features like reduced/automated data entry, and mitigated processing time/reconciliation period with easy and faster approvals.

- A tool that provides real-time tracking on a few aspects, like which bills need to be paid. When is it due? Who is to be paid and how much? would be a go-to choice for an accounts payable software tool.

- The accounts payable software should be capable of handling large volumes of invoices and should extend its benefits for invoice scanning/ processing with OCR (optical character recognition).

- An efficient accounts payable automation software tool should offer features that facilitate automated employer onboarding with electronic document matching, thereby preventing any forms of fraud or breach.

- The best accounts payable software solution should track the due date while also being capable of tracking early payment discounts and their optimisation. The ability to integrate with secured payment platforms is more necessary than easy integration with accounts payable solutions. Tools also offer global payments supporting multiple currencies and payment platforms.

- The software for accounts payable management should automate payment approvals, payment reconciliation, and cash flow optimisation. The tools for accounts payable management should also regulate the compliance measures adopted by the organisation and the vendor/supplier in some cases.

- The AP workflows optimise the cash workflows in an easier manner by reducing the dependency on manual labour for tasks like data entry, reconciliation, and validation.

Try Cflow for free, no credit card needed

Top Choices for Accounts Payable Software

1. Cflow

Cflow is a no-code workflow automation platform designed to streamline business processes like accounts payable, invoice approvals, and multi-level validations. It offers a visual workflow builder that allows finance teams to automate invoice capture, approvals, and tracking with zero coding.

Key Features:

Drag-and-drop workflow builder

Multi-level approvals with conditional logic

Real-time reporting and audit trails

Auto-reminders for pending payments

Secure cloud access and mobile app support

Best For:

SMEs and mid-sized UK businesses are looking for a scalable, easy-to-use solution with custom AP workflows and compliance controls.

Transform your AI-powered approvals

2. Xero

Xero is one of the most popular cloud accounting software platforms in the UK. It simplifies bookkeeping and includes built-in accounts payable tools to manage bills, automate payment reminders, and integrate with UK banks.

Key Features:

Bill entry and auto-matching to purchase orders

Batch payments and bulk reconciliation

Integration with over 800 third-party apps

Direct feeds from UK banks

Making Tax Digital (MTD) compliance

Best For:

UK small businesses, freelancers, and accountants are seeking a trusted, HMRC-compliant financial tool.

3. Sage Intacct

Sage Intacct is a powerful, cloud-based financial management solution designed for growing and mid-market businesses. Its AP automation module includes smart approvals, paperless invoicing, and deep integration with ERP systems.

Key Features:

Invoice capture and multi-entity support

Audit-ready reporting and custom dashboards

Purchase order matching

Payment scheduling and fraud controls

UK payroll and VAT compliance

Best For:

Mid to large-sized UK enterprises that require comprehensive financial oversight and automation.

4. Tipalti

Tipalti is a global payables automation system that helps businesses manage supplier payments, tax compliance, and financial reconciliation in one unified platform.

Key Features:

Supplier self-service onboarding

Automated tax form collection and validation (including VAT)

Multi-currency and cross-border payments

Built-in fraud detection

End-to-end audit trail

Best For:

UK companies with global vendor bases and high transaction volumes.

5. QuickBooks Online

QuickBooks Online offers cloud accounting with powerful AP functionality tailored for UK users. It simplifies bill entry, payment scheduling, and supplier management.

Key Features:

Digital invoice scanning and bill capture

Integration with UK banks and payment providers

Custom reminders and reporting

MTD support for VAT submissions

Mobile access and real-time syncing

Best For:

Startups and small businesses in the UK are looking for easy-to-use, affordable AP tools.

6. Zoho Books

Zoho Books is an online accounting solution that offers AP automation features, including vendor billing, approvals, and integration with Zoho’s broader business suite.

Key Features:

Vendor portal and recurring billing

Multi-currency invoicing

Expense tracking with approval workflows

Customisable reports and audit logs

HMRC MTD VAT filing support

Best For:

Cost-sensitive UK SMEs seeking an integrated finance and business operations solution.

7. SAP Concur

SAP Concur is an enterprise-grade platform that integrates AP automation with travel and expense management. It’s designed to handle complex financial approval chains and large datasets.

Key Features:

End-to-end invoice automation

Three-way matching for invoices, purchase orders, and receipts

Expense policy enforcement

Custom audit trails and analytics

ERP and CRM system integrations

Best For:

Large UK corporations or multinationals with complex approval workflows and strict compliance needs.

8. NetSuite ERP (Oracle)

NetSuite is a leading cloud-based ERP platform with robust financial management and AP automation capabilities. It unifies accounts, inventory, procurement, and more.

Key Features:

Centralised AP dashboard with real-time data

Automated invoice approvals and payment scheduling

Supplier performance insights

VAT and tax compliance tools

Global currency and subsidiary support

Best For:

Enterprise-level UK businesses need a complete finance and operations solution.

9. Coupa

Coupa is a spend management platform that includes intelligent AP automation to improve cash flow visibility, supplier engagement, and compliance.

Key Features:

AI-driven fraud detection

Dynamic discounting and supplier payments

e-Invoicing and global tax compliance

End-to-end audit trail and spend analytics

Supplier onboarding and performance tools

Best For:

Highly regulated UK industries such as finance, healthcare, and government.

10. FreshBooks

FreshBooks is a simple accounting tool designed with freelancers and microbusinesses in mind. It includes easy AP features like bill tracking, reminders, and expense categorisation.

Key Features:

Billable expense tracking

Automatic payment reminders

Vendor contact management

User-friendly interface and mobile app

Time-tracking and project billing

Best For:

UK freelancers, consultants, and creative professionals are looking for a straightforward AP experience.

End-to-end workflow automation

Build fully-customizable, no code process workflows in a jiffy.

Choosing the Best Accounts Payable Software

There can be numerous criteria like pricing, basic functionalities, general capabilities, specific features, ease of use, and scalability to evaluate and find the best fit or the suitable tool. Other aspects like integration capability, accessibility, flexibility, cloud assistance, and many more to be considered before getting an accounts payable solution implemented in your premises. Weighing such criteria depends on the business domain, legacy, and infrastructure.

So, here are a few questions that will prepare you for the process of analysing and picking an accounts payable solution for your organization without any complexities.

- Understand the uniqueness of your invoicing module. Get to know how your accounts payable ecosystem is functioning.

- What is the format used in your invoices, and what are the formats supported in your accounts payable landscap,e i.e. the formats for supplier invoices?

- How are the accounts matched and checked for reliability? What is the actual processing time?

- Does the current system use any workflow solutions? Can they be scaled to streamline the accounts payable process, too?

- How are your suppliers onboard, and what is their scope of visibility? Do they have access to your system?

- Does your environment support live syncing and tracking?

- Are there any measures to find the data deviations in the accounts payable process?

- Who has access to the document, or are they stored in a central hub?

- What is the grade on flexibility and integration?

- What payment platforms are supported, and do they allow multi-currency payments?

Some solutions are known for their enhanced securit,y while some excel with their real-time tracking. Some facilitate advantages like improving efficiency, while a few are best scalable. Research for redundancies and what causes the bottlenecks. Find the space for automation, which is still done manually, to avoid the loopholes.

So let’s do this checklist to know what to consider and what not.

- Invest in accounts payable software that allows multiple invoice formats, scanning methods, reconciliation techniques, electronic document matching, and automated approval workflows.

- Go for tools that support global payments and secure payment portal integrations. The tools should make seamless integration with your existing CRM and HRM or other software.

- Choose the one with automated invoice processing where the behind-scenes activities like receiving the receipts, data entry & storage, and reconciliation are also automated.

- Ensure the tool is flexible to collaborate with other departments through online and offline/centralised platforms. Do they comply with the internal and external policies?

- Pick one that has decent pricing and reviews. Know about their customer support and guidance provided before implementation. Do they provide demo and trial versions?

How Cflow Helps in Accounts Payable Automation?

With Cflow, you can tick all of the checkboxes above; additionally, we make your financial management more seamless with features of :

Centralised invoice payment/processing – as a cloud-based solution, users can capture, digitise, and store invoices in a centralised repository.

Automated forms– you can automate filling out your forms for tax collection and other audits, as automated forms in Cflow populate the expected items as per the user-defined rules.

Dynamic approval workflows– we are cloud-based and offer a no-code solution to ease out your workflow creation with and drag-and-drop interface.

Unleash the full potential of your AI-powered Workflow

Wrapping Up

Every tool has its unique features, specific strengths, and shortcomings. We have provided the best list of accounts payable software tools available in the market. Choose an accounts payable management software tool that aligns with your business’s bottom line and implement it (ticking the checklist given) to utilise the full potential of the solution. Simplify your business operation with automation solutions like Cflow to experience full control over your AP processes while also stepping towards business excellence. Kickstart your journey of accounts payable automation with Cflow. Sign up now.

Related Article:

- What is the 3-Way matching process and how does it Work

- A Strategic Approach to Automate Accounts Payable Process

- Decoding the Accounts Payable Workflow for Effective Automation

- 10 Ways to Make the Accounts Payable Process More Efficient and Productive

- End-to-End of Accounts Payable Process: From Start to Finish

- Top 14 Strategies For Accounts Payable Process Improvement In 2025

- 20 Key Benefits of Accounts Payable Automation

What should you do next?

Thanks for reading till the end. Here are 3 ways we can help you automate your business:

Do better workflow automation with Cflow

Create workflows with multiple steps, parallel reviewals. auto approvals, public forms, etc. to save time and cost.

Talk to a workflow expert

Get a 30-min. free consultation with our Workflow expert to optimize your daily tasks.

Get smarter with our workflow resources

Explore our workflow automation blogs, ebooks, and other resources to master workflow automation.

Get Your Workflows Automated for Free!

Missed deadlines, rising costs, and inefficient workflows—sound familiar?

Despite living in a digital-first world, many UK businesses still struggle to get their internal processes right. Whether you’re a fintech startup in London, a logistics provider in Manchester, or part of the NHS framework, clunky workflows can quietly erode productivity and profitability.

That’s where process improvement comes into play—not as a one-time fix, but as an ongoing commitment to efficiency and innovation. In a post-Brexit economy with growing compliance needs like GDPR, UK organisations must continuously refine how work gets done.

This blog unpacks key process improvement strategies, their relevance for UK businesses in 2025, and how no-code tools like Cflow enable rapid transformation without relying on heavy IT resources.

Introduction to Process Improvement

Wherever there is a process, there is always room for improvement. Business processes are not the fit-and-forget type, they need to be improved continuously so that the business stays relevant.

What is process improvement?

The proactive task of identifying, analyzing, and improving existing business processes in an organization for optimization and meeting higher quality levels and business goals is the definition of process improvement.

Process improvements follow systematic approaches that are based on specific business management methodologies suitable for businesses. Some management methodologies include benchmarking and lean manufacturing, each of which focuses on different improvement areas and follows different methods to achieve process goals.

While improving processes, process workflows may either be modified or complemented with sub-processes, or redundant processes may be done away with altogether. The definition of improvements is not restricted to improving the efficiency of standalone processes, but rather complete organisational development and improvement.

The process of improving is not a one-off initiative, but rather an ongoing practice that should always be followed up with the analysis of tangible areas of improvement. The results of a successfully implemented process improvement initiative can be measured in the enhancement of product quality, increased productivity, customer loyalty, and customer satisfaction.

Process improvement methods enhance process productivity, help develop the skills of employees, increase profit and efficiency, and ensure a faster return on investment.

Process improvement can have several formats:

- business process management (BPM),

- business process improvement (BPI),

- business process reengineering, or

- continuous process improvement.

Irrespective of the terminology, all methods focus on minimising errors, reducing wastage, improving productivity, and streamlining process workflows.

Process improvement is often confused with business process reengineering (BPR). BPR is a practice that is applied to processes that require major and drastic changes. Companies that are looking at complete process redesign usually go for BPR.

Business process improvement, on the other hand, is used for workflows that require modifications that do not alter the essence of the process. BPR is usually executed on broken processes with expected results of up to 90% better budget optimisation, speed, and quality.

Process improvement focuses on processes that need to be enhanced, with improvements expected within the 10-30% range. In some cases, BPI and BPR can be implemented together to achieve common organisational goals.

The decision to automate must be backed by a complete analysis of the process. The purpose of the existing process must be understood first before going for process improvement. This analysis will help identify if the process is moving towards the expected goals. The resources to be allocated to the business process improvement must also be considered before initiating process improvement. The success of process automation can be measured by the KPIs that help evaluate the effectiveness of implementation.

Need for Process Improvement

How do you recognise the need for process improvement?

There are several telltale signs that your business requires process improvement.

A 2023 study by KaiNexus revealed that 33% of process improvement initiatives have a direct financial impact, with 80% of these resulting in recurring annual savings. Additionally, 54% of improvements enhance quality, and 25% lead to time savings. These findings underscore the importance of identifying and implementing process improvements strategically to maximise return on investment.

Here are some reasons why your business may need process improvements:

Growth

Some businesses are growing so fast that they need to make process improvements regularly to make processes more efficient. Business growth brings more customers, more steps and controls, and more employees. Maintaining steady business growth requires process improvement methods like automation.

Launch of new products and services

Behind the successful launch of new products and services is a change or improvement of processes. Leading organisations like Pixar and Toyota have implemented continuous improvement methodologies to ensure the quality of the products they have developed. Any new product launch requires considerable improvements/changes in the existing processes.

Regulatory compliance

Keeping up with safety, governmental, and industry regulations adds to the bureaucratic burden of current business processes. Every time new regulations occur, it is important to review processes to ensure that they are compliant. Any non-compliance may need changes or improvements in the process to ensure 100% compliance.

Starting a new business

Startup businesses look at various ways to sell their products. Standardised processes are required to sell the product well and also to serve the customer efficiently and consistently. At the beginning of every startup journey, sales move fast, the real challenge is to maintain sustained sales for longer periods. Improving processes ensures that sales volumes are maintained.

Reduce costs

Businesses that are known for providing low-cost products and services to their customers need to improve a wide range of operational processes. Companies that are not focused on low cost may need to work on cost-cutting when clients ask for it. Streamlining processes by adopting lean management methods to reduce waste and lower costs.

New technologies

As new technologies emerge, business processes need to be updated accordingly. Sometimes, the process may not be affected directly, but processes at the customer’s or supplier’s end may change. To keep up with these changes, a business may need to change its processes.

New employees

While hiring new employees, companies need to have a planning methodology that takes strategic priorities from the top and works them through the company to the bottom. Improving existing processes ensures that tasks are effectively delegated to team members.

Improving sales

Companies that are looking to increase sales might want to re-examine their sales processes to locate the missing steps or procedures not being followed, or underutilised sales channels.

Mergers and acquisitions

Whenever mergers and acquisitions happen, processes from different companies and cultures need to be aligned and combined seamlessly so that business operations are not interrupted. In order, that process duplications and extra work to be avoided, process improvement methods need to be implemented.

You need to evaluate existing processes by asking the following questions –

1. Where are the bottlenecks?

2. How involved are your employees as a team?

3. Does it give them the big picture to work towards a bigger goal?

4. How many splits can a single process undergo for maximum efficiency?

5. Are there any steps that take more time, and is it truly justified?

6. What will the initiative improve in the process?

Benefits of Process Improvement

A process improvement plan for each organisation might have a completely different set of goals and objectives. Some of them might be targeting improving productivity, or it could be achieving more visibility and accessibility into the process. Remember that these goals and objectives could change over time. Hence, implementing process improvement strategies can seamlessly deliver these goals as well as provide the following benefits.

Time-Saving

Most business processes are repetitive and often tend to slow down the pace of the process. With process improvement, the tasks in the processes are streamlined and optimized to maximum efficiency by removing redundancies. Therefore, the tasks are completed with minimal usage of time usage as the number of steps is reduced.

Improved results

Process improvement is practised to improve the processes, hence the processes are transformed to show substantial growth. The growth will be visible in better outcomes, workforce performance, and the overall productivity of the organisation.

Enhanced Customer Satisfaction

With better and improved processes and improved output, the end users or the customers are highly satisfied. There is increased responsibility for the service provided to the customers.

Increased Transparency and Alignment

A process improvement would generally stabilise the process and encourage proper coordination among the workforce across departments. There is improved visibility into the business operations that enables real-time progress monitoring of the process.

Reduced Wastage of Resources

Unnecessary usage of resources is completely erased from the processes as the redundant tasks that take up extra time and energy are removed.

End-to-end workflow automation

Build fully-customizable, no code process workflows in a jiffy.

Why Process Improvement Matters for UK Businesses in 2025

In the UK, businesses face a unique blend of regulatory pressures, economic shifts, and rising customer expectations, especially in post-Brexit markets. Efficient processes aren’t just about internal productivity anymore—they’re about survival and competitive advantage in a fast-evolving landscape.

For example, with the UK government’s Making Tax Digital (MTD) initiative and GDPR regulations, companies must constantly evaluate and optimise finance, compliance, and data workflows. Process improvement helps meet these obligations while staying agile. Additionally, sectors like manufacturing, logistics, and healthcare are investing heavily in lean process improvement to address labour shortages, inflation-driven costs, and rising demand for real-time service delivery.

Whether you’re a London-based fintech startup or a manufacturing firm in Manchester, process improvement backed by automation ensures you’re not just operational—but strategically scalable. Adopting no-code platforms like Cflow allows UK SMEs to cut overheads, improve compliance, and adapt to the challenges of a digitised, regulated economy, without the need for IT resources.

How to go about Process Improvement?

To identify opportunities for process improvement, start by defining the processes that exist in the organisation. Once the process issues are identified, the next step is to choose a process improvement method that involves key players in the organisation for spotting improvement opportunities. Choosing the right methodology helps businesses set parameters that identify opportunities and steps toward improvement.

Here are some simple steps to guide you through process improvements:

1. Review Existing Processes

There could be many hidden potholes in your existing process, which is why it is important to start by reviewing it and identifying the weak points.

2. Understand the Shortcomings

Instead of trying to fix a process individually at different points, review and analyse it as a whole. Once you have fully understood the process, start by removing the shortcomings and building an entirely new process for maximum efficiency.

3. Edit and Make Necessary Changes

Based on the identified shortcomings, make the corrections necessary to your process. No process is perfect on day one; go ahead and continue to iterate to evolve into a near-perfect version.

4. Design a New Process

Create a flowchart or line diagram to easily understand how one task should move from an individual to the rest of the people in the team. Put it into action and see if there are still issues that persist.

5. Implement the Process and Witness Changes

Give it time once you have created and implemented a brand-new process. Don’t make changes immediately, but give it a couple of days or weeks, based on how complicated or big it is, before making minor changes.

6. Conduct Process Improvement Reviews Regularly

The goals and objectives of the process keep changing, and the business processes must be potent enough to adapt to the changing needs. Therefore, conducting process review sessions regularly is necessary for two reasons. First, to gauge the degree of improvement in the improved process, and second, to implement important changes to the process to achieve the newly set aims and standards. Review sessions will also help to determine if the improvement is working for the process as well as your organisation. Most often, there are chances of detecting more areas of refinement with the process over time. Gradually, the areas can be developed according to the different needs.

Types of Process Improvements

Through process improvement techniques, companies aim to improve internal workflows, which in turn improve product service and quality, reduce billing cycles, and improve delivery times. Depending on the aim of process improvement initiatives, they are classified into the following types:

Cost-cutting – Restructuring key business processes is an effective way to streamline processes. It also helps ascertain process redundancies that lead to increasing costs. Unnecessary tasks are eliminated through restructuring, which paves the way for optimal resource allocation.

Improving communication – Process improvements also aim to establish a clear communication stream within the process. Unlike manually operated processes that entail several rounds of email communication, process automation decreases the volume of email exchanges and contact touchpoints between workers and departments. Communication streamlining can be achieved by special software that helps employees see and share necessary information. Using this software, cross-departmental alignment and transparency can be improved considerably.

Process visualisation – Visualisation of processes can be done via process mapping. Process models can greatly simplify auditing, make improvements, and identify bottlenecks as they arise.

Process Improvement Techniques

Several business improvement methodologies are aimed at helping your organisation tackle process issues by analysing and fixing them. Each method suits a different business need. Some focus on getting the company culture into the groove for process improvement, and some on lean process techniques. Commonly followed process improvement techniques are listed below:

5S –

This is part of the Kaizen and Lean methodologies. 5s stands for sort, straighten, shine, standardise, and sustain. This process improvement model brings more consistency and standardisation to the process improvement efforts.

Kaizen –

This methodology promotes continuous improvement with a strong emphasis on lean and agile practices. Kaizen focuses on improving quality, productivity, and efficiency through small and progressive shifts in daily work or corporate culture to foster an environment that does not punish mistakes or errors. This method focuses on preventing mistakes or errors from happening again.

PDCA –

This is also part of the Kaizen methodology and stands for Plan, Do, Check, and Act. This method is effective in identifying processes that need improvement, thereby making the organisation more efficient. The first step is to identify the issue (plan), create and implement a solution (do), evaluate data for effectiveness (check), document the final results, and implement the plan if it is successful (act).

Six Sigma –

This is among the most popular process improvement methods that pull workers up through ranks, classified using karate belts. The starting stage is the green belt, and the highest is the black belt. There are 2 ways to break down process improvement through specific steps by following the Six Sigma model. The steps in Six Sigma could either be defined, measured, analysed, improved, and controlled (DMAIC) or defined, measured, analysed, designed, and verified (DMADV).

Cause and effect analysis –

Another process improvement tool derived from Six Sigma is the Cause and Effect analysis. As the name suggests, this method aims at identifying the problem (cause) using a diagrammatic approach. Once the problem is identified, the relevant roadblocks are discovered to ascertain why the process isn’t working.

SIPOC analysis –

This is another diagram-based Six Sigma approach that happens during the Measure stage of DMAIC or DMADV. Using the SIPOC analysis, organisations define and establish a process improvement project and identify requirements before starting.

Value stream mapping (VSM) –

The customer’s perceptions of a business process are visually represented by the VSM method. This representation helps identify the value of a product, process, or service to the organisation by eliminating waste and redundancy.

Total Quality Management (TQM) –

This process improvement method focuses on long-term success by ensuring customer satisfaction. TQM also helps get the entire company on board for continuous process improvement. Organisations that follow TQM create a culture where employees are not afraid to make mistakes and are driven toward shared business goals.

Kanban –

This is a tool used for process workflow visualisation that brings business units, employees, and leadership on the same page for process improvement. The Kanban approach incorporates and advocates lean process improvement.

Process mapping –

This is another workflow visualisation method that helps companies map out a plan for process improvement. Process mapping can be done via process flowcharts, functional flow charts, process models, and process charts. Important information about the process workflow from start to end can be derived from process mapping.

GAP analysis –

A process analysis method that focuses on identifying where a current process fails to meet requirements or where a process deviates from the expected route.

Business Process Management –

Business Process Management is the method of analysing and optimising different business operations to higher levels of efficiency. BPM is one of the effective ways to achieve process improvement that involves complex processes and tends to have several limitations. This type of management system becomes the best solution to the growing needs of the business. The major steps involved in this management system are as follows:

Analyse: This is the stage where the current processes are analysed and evaluated for any drawbacks or areas of improvement.

Model: Once the inefficient processes are detected, a framework or model is drafted for how the process has to be developed. According to this framework, the improvement methods are implemented.

Implement: Implementation is the process of putting the new model of improvement into action.

Monitor: In this stage, the review of the improvement plan is done, and the success rate of the newly upgraded process is measured.

Optimise: The consistent review process will automatically uncover more areas of improvement that have to be optimised at this stage. This can be achieved using automation software

Theory of Constraints –

The theory of Constraints is yet another method of process improvement that deals with identifying and eliminating constraints as quickly as possible. The idea here is that the goals or outcomes have to be achieved without causing any delays or other limitations. This is one of the fastest ways of implementing an improvement plan.

Lean Six Sigma –

Lean Six Sigma is a combination of Lean and Six Sigma. Lean is the method that is specifically practised for process improvement in the manufacturing industry. However, the principles and theories of Lean can be implemented in other industries as well. This technique is particularly adopted by organisations to focus on the reduction of wastage of important resources like time and labour. This method has the potential to remove redundant and inefficient tasks, stages, or resources in the processes that do have the potential to deliver the right outcomes to the customers or the end users. Broadly, five steps are identified in this method. The steps include:

- Identify Value

- Map Value Stream

- Create Flow

- Establish Pull

- Seek Perfection

As mentioned earlier, the Lean Six Sigma process is a blend of two different methods, Lean and Six Sigma DMAIC, which holds the ability to drive the organisational processes to efficiency, with the focal point being quality control and waste reduction.

Also Read: 3 ways individual could improve

Process Improvement Examples

The main intent of process improvement is to make processes more effective. Here are some examples:

Process improvement to eliminate waste – Any process improvement that focuses on eliminating wasted effort, time, materials, and energy falls under this category. For example, a carpenter puts the nails required in the belt so that they do not have to search for parts.

Process improvement to eliminate steps – Removing repetitive or redundant steps from the process. For example, the removal of 3 questions from a mortgage application that do not correlate to any meaningful differences in risk or compliance.

Process improvement for planning – This involves adding or removing steps within a process. For example, a sales team removes the requirement that sales teams develop a plan for each account because they produce low-quality work that doesn’t improve revenue.

Bottom-up process improvement – This method allows ideas from anywhere to flow into your process endeavours. For example, an airline that changes its check-in process based on a suggestion from a passenger.

Process improvement by restructuring – Changing the organisational order or structure to make processes more efficient. For example, a bank that changes its IT department such that developers who write the code are always responsible for supporting the same code in production.

Process improvement by root cause analysis – This method looks for the source of the problem. For example, poor customer service is not caused by employees or training but by an inefficient software tool that adds stress to every customer interaction.

Process improvement by altering priorities – Structuring the priorities of the process. For example, in a manufacturing line where each employee is aware that safety is a priority, and hence stops the line for a perceived safety issue.

Process improvement by pull process – This method allows demand to pull supply to avoid waste. For example, a car manufacturer doesn’t manufacture your car till an order is placed.

Process Improvement by Reengineering – This is an alternative to continuous process improvement that seeks to transform a process. For example, an e-commerce company builds a completely automated order fulfilment process from the ground up without any reference to existing manual processes.

Some of the other examples of primes for process improvement are:

• System downtime in manufacturing facilities

• Time-consuming approval processes

• Disempowered, single-task employees

• Unused product inventory

• Processes that involve excessive non-billable hours

• Duplicate reporting

• Excessive email or Slack communication

Process Improvement and Automation

Automating process workflows is a process improvement method that focuses on reducing human error, human bias, and inconsistencies in any process. Automation is one of the most effective ways of eliminating the manual burden and minimising human error and bias.

Process automation helps organisations understand where and what they need to improve and what is working as it should. Robotic process automation (RPA) is among the most popular forms of process automation being adopted by businesses. RPA enables organisations to mimic human actions for tasks or steps in complex processes.

A set of business rules and triggers is an integral part of robotic automation solutions. Automating processes eliminates the need for manual labour in specific parts of the workflow, allowing the RPA to do what humans were previously doing. Some common processes that are automated with RPA include automated email responses, online order processing, categorising help desk tickets, payroll management, and data exchange between disparate systems. When such tasks are automated, it improves the overall efficiency of the process and frees up workers from performing repetitive and mundane tasks.

Workflow automation using a no-code BPM solution like Cflow is a quick and effective way to improve the overall efficiency of the process. The visual form builder can be used to build workflows for key business processes like finance, procurement, and HR. The intuitive dashboard in Cflow gives the users a bird’s-eye view of the process status. Controlled access to sensitive business data ensures the safety of data. The workflows can be completely customised as per the unique requirements of the business. Cflow can be seamlessly integrated with other business systems for seamless data exchange.

Conclusion

No matter the size or sector, UK businesses must embrace continuous process improvement to remain resilient and agile in a climate of economic change, regulatory shifts, and rising customer expectations. Identifying what’s slowing you down and automating the right workflows can lead to better performance, stronger compliance, and happier teams.

With a no-code platform like Cflow, UK organisations can unlock faster ROI by streamlining approvals, eliminating manual tasks, and gaining real-time visibility into operations. Whether you’re focused on scaling sustainably or simply want to cut inefficiencies, the right process improvement strategy can set you apart in a crowded marketplace.

Ready to improve your business processes without the complexity? Try a demo of Cflow today.

What would you like to do next?

Automate your workflows with our Cflow experts.