Business Process Management in Banking and Financial Industry

Key Takeaways

Manual banking workflows lead to delays, errors, and compliance issues – automating them with BPM and RPA improves speed, accuracy, and audit readiness.

Processes like KYC, loan approvals, and credit card processing can be streamlined through automation, significantly reducing turnaround time and paperwork.

Robotic Process Automation (RPA) in banking cuts operational costs by up to 50% while enhancing efficiency in areas like fraud detection and accounts payable.

Omnichannel banking experiences—via mobile, web, ATM, and IVR—are powered by BPM solutions that ensure real-time updates and seamless customer service.

AI and advanced analytics help banks personalise services, predict customer needs, and automate rule-based queries for faster issue resolution.

No-code BPM tools like Cflow make it easy for banks to automate processes without developer support, accelerating digital transformation at lower costs.

Banking Process Management has garnered the interest of the banking and financial industry over the past decade. There is an ever-increasing demand for mobile and online banking services, as banker gets tech-savvy by the minute. Convenience, speed, and accuracy are expected with every banking transaction.

Weaving digitisation into the fabric of banking services enables banks to keep up with evolving customer expectations and cut-throat market competition. Automation of banking processes helps optimise and streamline banking operations.

Redefining Banking and Financial Industry through Business Process Management

Banking functions may be broadly classified into deposit, credit, and loan processing functions. Optimising and streamlining core banking operations provides huge cost and time savings. A good understanding of the banking process flow is essential to deciding on automation for banking. Given below is a brief introduction to the main banking functions.

Customer Onboarding:

A smooth and quick customer onboarding process wins the trust and loyalty of the customer. Legacy banking institutions depend on manual methods for gathering and verifying customer information. Modernised banks gather customer information through websites, mobile devices, and third-party platforms.

Know your customer (KYC) verification is an important/mandatory part of the customer onboarding process. Owing to the rise in online fraud and financial terrorism, banks have made the KYC process mandatory. Anti-money laundering checks are also mandatory in customer onboarding. Gathering and verifying customer data from multiple sources can be cumbersome and error-prone when done through manual banking.

Loan Processing:

Loan processing is an exhaustive process with several important steps from loan origination to disbursement. Legacy banking systems process loans manually, which entails tons of paperwork, inordinate delays in approvals and verification, unexplained bottlenecks, increased scope for fraud, and multiple rejections and re-applications. Modern banks need to have speedy and efficient loan processing systems that can handle huge volumes of loan originations across multiple platforms.

Credit Card Processing:

Credit and debit card processing is an expensive process that requires accurate capture of data across multiple banking channels and real-time updating of bank records. When done manually, credit card processing not only takes time and effort but is also prone to errors and inconsistencies. Automated credit and debit card processing cuts down significantly on the cost and time of processing and ensures 100% accuracy.

Core Banking Operations:

Core banking operations make up all the back-end updates in the banking industry. These processes include customer data updates, KYC validations, accounting reconciliations, and overdraft protection. Speed and accuracy are paramount for core banking operations. Manual updates cannot provide the accuracy and speed required in core banking operations. Automated processing, especially robotic process automation (RPA), can increase the accuracy and speed of core banking operations.

Risk and Compliance:

Banks and financial institutions need to adhere to several policies and regulations. Updates on financial regulations and the creation of new policies are a routine feature in the banking and financial industry. Risk and compliance management is an important function in banking. Banks and financial institutions need to be audit-ready at all times by updating their data and policies. Anti-money laundering and fraud checks, KYC verification, and compliance checks can be effectively done through automation.

Current Scenario in Banking Services

Most of the core banking systems were built in an age where new product launches could take a long time and were likely to disrupt business operations. Over the past decade, there has been an increased sophistication of front and back-office banking operations.

Banks have embraced IT services to improve customer experience and the efficiency of banking operations. Customer relationship management (CRM) systems, loan origination systems, and channel systems are examples of the “surround” systems that envelop the core systems, which makes it easy to modify application logic.

Regulatory compliance is another challenge faced by banks today. Banks need to update their policies and operations as per regular changes in compliance mandates. New regulations like FATCA compliance in the USA, RDR compliance in the UK, and chip card mandates in Canada require additional IT investments. Regulatory compliance is driving banks to embrace modern technology for risk and compliance management. Tackling financial crimes like money laundering, financial terrorism, and loan defaulting requires banks to adopt automation technologies.

The millennial culture is seeing a rapid rise in omnichannel banking operations. Banking services and customer information must be accessible from multiple channels/sources like ATMs, Internet banking, Mobile Banking, IVRs, etc. Providing a seamless customer experience across these channels can be a key business differentiator for banks. Advanced analytics of data across multiple channels helps banks streamline their services.

Banks and financial institutions require a Business Process Management (BPM) solution that covers multiple aspects of business operations.

BPM in banking needs to cover 3 main dimensions:

- Human and system processes: Human process systems include operations performed by users, customers, and human stakeholders. System processes include system workflows, human-system interactions, and system interconnections

- Business rule engines: Rule engines are the basis for automating banking systems

- Business activity monitoring: This provides visibility into the system processes used currently

Key business requirements like mergers or acquisitions, regulatory compliance, and the need for operational flexibility are the drivers of business process automation in the banking industry.

Benefits of Automated Banking and Financial Services

The productivity and efficiency of core banking services can be greatly improved by automating banking and financial services. Business process management is a combination of tools and techniques that make banking services more efficient and flexible. Automating key banking workflows helps eliminate redundancies and streamlines the process. Corporate and retail banking automation enables banks to strengthen their resilience and improve customer experience.

Recent market research by Fortune Business Insights reveals that the Core Banking Software Market is poised to reach 28.83 billion USD by 2027. The report identified increased adoption of SaaS-based and Cloud-based banking software solutions as key drivers of market growth.

Implementing banking automation processes enables banks to align their operations with overall business objectives and strategies. BPM software automates important banking process workflows like account opening, KYC verification, loan processing, and compliance management. BPM in banking helps in the resolution of issues in banking services and creates a flexible environment for process improvement. Progressive banks and financial institutions are increasingly adopting BPM solutions to eliminate errors in banking workflows and speed up processes.

The key benefits of automation in the finance and banking industry are:

- Reduction in employee workload: Automation of low-value, repetitive steps in a banking workflow can help reduce human intervention. Employees are relieved from performing admin tasks and get time to focus on project-related work.

- Reduction in the cost and time for completing tasks: Automation streamlines banking processes, thereby eliminating repetitive steps. The cost and time spent on these repetitive steps are proportionately reduced through banking automation.

- Increased operational agility and flexibility: Automation brings agility and flexibility into banking operations for adopting application changes or improvements in the future.

- Improvement in customer SLAs: Automation enables banks to improve their customer service across various channels.

- Fosters customer trust and loyalty: Ensuring smooth flow in processes like customer onboarding and customer support wins customer trust and loyalty. Automation streamlines the customer onboarding process and accelerates the response to customer support queries.

- Enhanced customer experience: Automating banking workflows ensures speedy resolution of customer issues and queries. Overall, customer experience can be enhanced by automating core banking processes.

- Improved regulatory compliance: Seasonal audits are common in banking and financial institutions. Regulatory compliance management can be challenging with policies and regulations being updated on a regular basis. Automated risk and compliance management helps banks steer clear of fraudulent practices.

Business Process Management (BPM) in the Banking Industry

The banking and financial industry is one of the leading investors in technology and automation. A decade ago, banking and financial transactions, especially the ones performed manually by employees, were considered difficult to automate. Owing to the rapid rise in digitisation and automation technologies, some of the leading banks across the globe are investing heavily in automating their key process workflows.

Business process management in banking weaves flexibility and agility into banking operations. To understand the effectiveness of BPM in banking, let us consider the following example:

A customer deposits cash or cheques in an ATM. The transaction details are communicated to the banking facility and the mobile banking app. Once the customer logs into the mobile app, the transaction update is received immediately. Updates across multiple channels are possible with BPM in banking. The above example of banking automation elucidates how BPM provides a seamless view of the transaction from start to end. This visibility helps banks manage and optimise their customer-based operations.

Business process automation in the banking industry helps manage internal monitoring of processes like compliance management. Banks that implement BPM are in a better position to identify competitive advantages, deliver results, and establish internal processes. The retail banking business process structure provides ample opportunities to apply BPM processes. BPM software helps transform banking operations by providing better visibility and control of critical workflows, eliminating errors, and accelerating customer response time.

The main objective of process automation in banking and financial services is to achieve flexibility and agility in banking services. Retail and corporate banking business process flow can be streamlined and optimised by BPM automation software.

The best way to derive maximum benefits from BPM software is to carry out the implementation in stages.

End-to-end workflow automation

Build fully-customizable, no code process workflows in a jiffy.

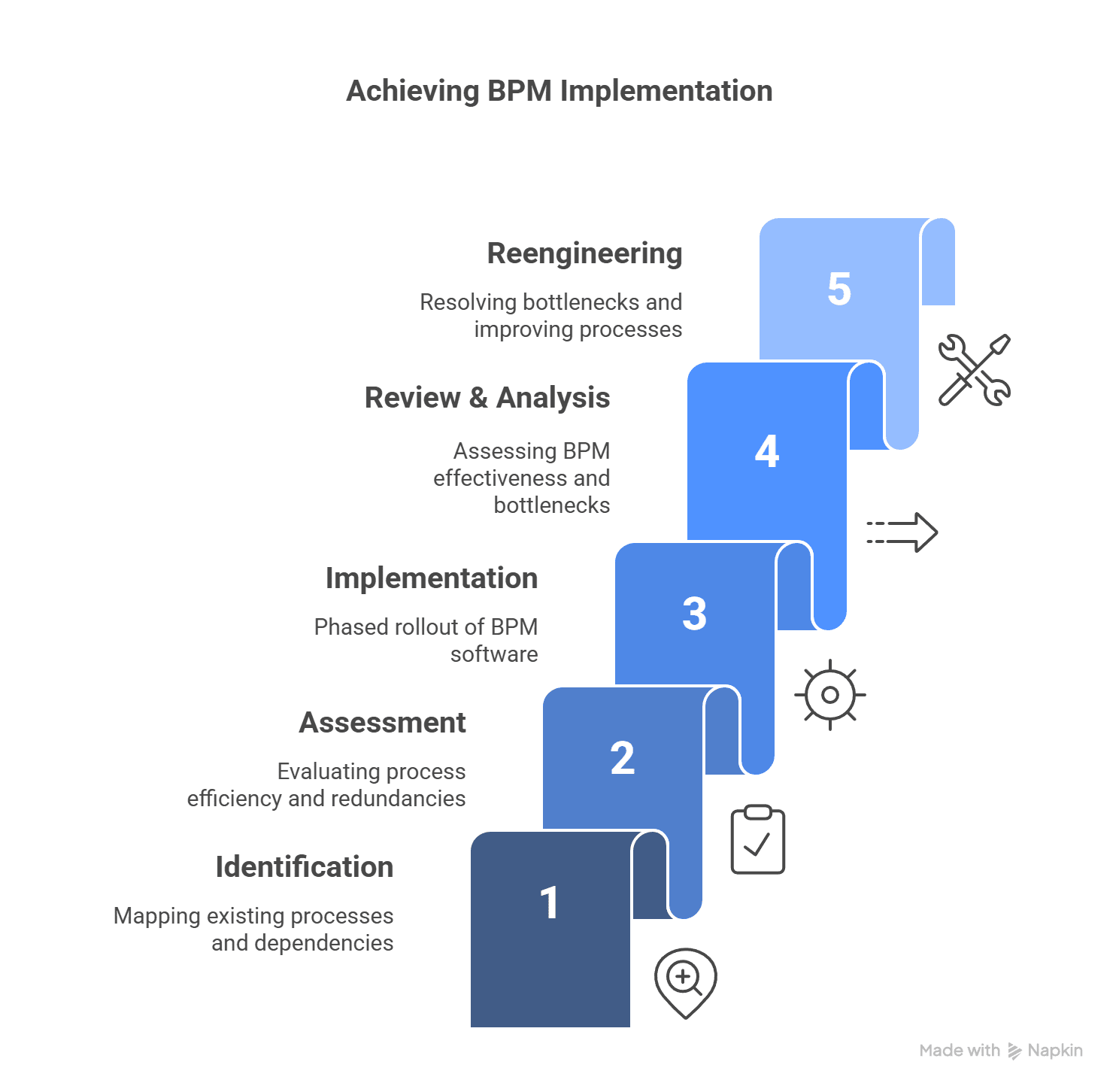

The following steps in BPM implementation may be followed:

Identification

The first step to improving process efficiency is to map the existing process workflow. Existing processes across systems and departments need to be identified by mapping individual tasks. All the dependencies, business rules, stakeholders, systems, and tasks that the process involves also need to be identified. Documenting the process workflow in the form of a flow chart or workflow diagram helps in subsequent steps.

Assessment

Once process steps and dependencies have been identified, the next step is to assess the entire process. Assessment should be done based on turnaround time, the number of tasks, complexity, and the number of systems. Careful assessment helps identify the repetitive steps and process redundancies. The decision on which process is best implemented through BPM can be taken based on this assessment. Banking institutions should also consider various BPM tools available in the market.

Implementation

Once the processes for BPM implementation are chosen, BPM must be implemented, starting with smaller processes. Upon successful BPM implementation with small processes, larger and complex processes may be taken up for BPM implementation. Phased implementation of BPM by starting with processes within a department and then moving on to processes spanning various departments yields the best results.

Review and analysis

The effectiveness of BPM software implementation must be reviewed and analysed. Key performance metrics like turnaround time, response time, and cost need to be reviewed and compared with pre-implementation values. Process bottlenecks must be identified, analysed, and resolved to improve process efficiency.

Reengineering and improvement

Any process bottlenecks that are identified in the review step need to be resolved by rearranging or redefining tasks. Continuous assessment and improvement of processes is the goal of BPM implementation for banking.

The main objective of process automation in banking and financial services is to achieve flexibility and agility in banking services. Retail and corporate banking business process flow can be streamlined and optimised by BPM automation software.

Robotic Process Automation (RPA) in Banking

Automation in the finance sector can be effectively done through robotic process automation (RPA). According to Grandview Research, the global robotic process automation in the BFSI market size is expected to grow at a CAGR of 31.3% between 2019 and 2025.

The banking and financial services industry has several processes running in the front and back end. The efficiency of these functions can be significantly improved by robotic process automation. Accounts payable, customer service, mortgage loan processing, account closure, and credit card processing are some examples of robotic process automation in the banking industry.

The BFSI sector is implementing RPA and AI technologies to improve the efficiency and productivity of banking workflows. Here is a list of banking processes that can be automated through RPA:

Customer service:

Banks are required to address thousands of customer queries ranging from account information to application issues. The shorter the turnaround time, the higher the customer satisfaction. RPA can effectively automate such rule-based processes, enabling banks to respond to queries in real-time and bring down the response time to seconds.

Compliance management:

The banking industry is closely governed by regulatory policies. Compliance management is a challenge, given the frequency at which policies are updated. RPA helps in maintaining the accuracy and quality of compliance management.

Credit card processing:

Credit card processing typically took weeks to process and validate when done manually. Robotic process automation helps speed up credit card processing by enabling seamless interaction between multiple systems. Validation of documents, credit checks, and background checks can now be done within hours.

Accounts payable:

Accounts payable is a straightforward process that involves well-defined steps. These steps can be time-consuming and repetitive when executed manually. RPA can effectively automate the accounts payable process by using the optical character recognition (OCR) process

Loan processing:

Manual loan processing takes anything between 1 -2 months. The entire process is dotted with stringent checks, validations, and inspections. There is absolutely no scope for error or overlook in the process. RPA can be used to speed up the validation steps and ensure error-free loan processing.

Know your customer (KYC):

Banks have made KYC checks mandatory for all account holders. The entire KYC process takes over 1000 FTEs, which is a huge cost for banks. RPA enables banks to complete KYC within a short span with minimal staff and errors.

Fraud Detection:

With the disruption of digital technology in banking, online fraud is one of the major concerns for banks. Detection of fraudulent transactions, sifting through millions of transactions, can be challenging when done manually. RPA can effectively flag off a fraudulent transaction to the concerned authority in real-time; in some cases, even prevent fraud by blocking suspicious accounts.

Report automation:

Banks and financial institutions need to gather data and present the report to all stakeholders. Manual report preparation is prone to errors and discrepancies. RPA can create accurate reports without any error and in much less time than manual processes.

Account closure:

Account closure can happen due to various reasons, ranging from elective closure to failure in document verification. With RPA, it is extremely easy and quick to track accounts that failed document verification and send automated notifications for document submissions.

RPA enables banks to do more with fewer human resources. There are several benefits of automation in the finance and banking sector as listed below:

Cost Savings:

Statistics show that RPA drives about 25 to 50% cost savings for banks by optimising banking workflows.

Improving Operational Efficiency:

By cutting out repetitive steps, RPA can reduce processing time and improve the operational efficiency of banking processes.

Improved customer experience:

Banks are adopting RPA for faster process execution and shorter turnaround time. Faster response to customer queries improves overall customer experience and reduces operational costs by 75%.

Quick and easy installation:

Most RPA tools use drag-and-drop functionality that enables faster and easier implementation. No code or minimal coding enables easy implementation and maintenance.

The Digital Future of Banking Services

Bill Gates once said, “Banking is necessary, but banks are not”.

Banking is part of our everyday lives. However, the way people interact with banks has changed significantly due to digital disruption. Tech-savvy millennials expect a seamless banking experience across various digital banking channels. Banking automation has altered the business process framework of the banking industry. Banks need to rethink/redefine the way they interact with their customers. Digital banking is all about providing an outstanding customer experience across multiple digital channels.

Consumers’ increasing need for accessing banking services from digital channels has led to an increase in new banking technologies that are redefining the banking landscape. The new digital banking platform must include the following components:

Omni-channel customer experience:

Today’s banker accesses banking services from mobile, web, and other digital channels. Banks are expected to provide their customers with a seamless, near-real-time omnichannel banking experience. Banks will have to re-engineer their banking platforms to be digital-first. Banking services must focus on generating a seamless omnichannel experience that is mobile-friendly and can be repurposed across other digital channels.

Customer analytics:

Understanding your customer journey requires powerful digital analytics. Leveraging Big Data analytics and geolocation technology, banks can now analyse customer habits and preferences. This understanding helps them anticipate customers’ needs and provide relevant offers and services. Customer analytics can also be leveraged as a product development tool.

There are many banking processes where RPA, AI, and Machine Learning are being deployed to increase productivity and efficiency. Banking automation is key to surviving a hyper-competitive market and increasing customer expectations. The advantages of automation in the banking sector are driving more banks to embrace BPM software to automate their key workflows.

Here are 5 key trends that are expected to restructure the banking services landscape:

- The rise in customer expectations for online and mobile banking – Seamless, omnichannel banking experience across various digital banking channels will become a basic banking requirement.

- Data security to become vital – With the rise in online fraud and cyberbanking crimes, data and information security will become a top priority for banks.

- AI and RPA to provide more context – As banks continue to prioritize speed and quality of customer experience, AI and RPA will play a key role in providing context and streamlining customer interactions. AI chatbots can be used for handling low-value tickets and customer queries for a faster turnaround time.

- Voice AI to redefine banking experience – By integrating voice-based technology and voice activation, bankers can conduct secure banking transactions. Other banking services like checking account balances, transactional history, and digital bank statement requests can also be voice-activated.

- Increased adoption of Open APIs and Microservices architecture – Digital banking services need to support seamless integration and agility. Open APIs enable smooth interoperability between different mediums, which helps the bank’s core system to engage with third-party vendors. Microservices architecture can be used to break down banking applications into sub-services that can communicate seamlessly via open APIs.

Conclusion

Business process automation in the banking industry is here to stay. The market is flooded with BPM solutions for automating key banking solutions. Cflow is a no-code BPM solution that offers diverse automation solutions for various requirements in the banking and financial sectors.

To know more about Cflow, sign up for a free trial today.

Frequently Asked Questions (FAQs)

1. Why should banks automate their business processes?

Manual banking workflows are slow, error-prone, and costly. By automating key processes like loan approvals, KYC checks, and account management, banks can reduce turnaround times, improve compliance, and deliver a better customer experience.

2. What’s the difference between BPM and RPA in banking?

Great question! BPM (Business Process Management) focuses on improving entire workflows end-to-end. RPA (Robotic Process Automation), on the other hand, automates specific rule-based tasks within those workflows, like validating documents or sending alerts.

3. Which banking operations benefit most from automation?

Processes like customer onboarding, credit card processing, accounts payable, compliance management, loan origination, and fraud detection are all great candidates. These tasks are repetitive, data-heavy, and often time-sensitive—perfect for automation.

4. Can automation help banks with regulatory compliance?

Absolutely. Compliance is a major pain point in banking, with constant policy updates and audits. Automation ensures consistent documentation, real-time updates, and accurate reporting, helping banks stay compliant and audit-ready.

5. Is it expensive or complex to implement BPM in banking?

Not anymore. With modern no-code BPM tools like Cflow, banks can automate processes without heavy IT investment or coding. Start small, automate department-wise, and scale gradually—it’s efficient and cost-effective.

6. How does automation impact the customer experience in banking?

It improves it dramatically. Faster onboarding, real-time updates, and 24/7 query resolution through AI and RPA lead to happier, more loyal customers—exactly what modern banks need to stay competitive.

Related Articles:

- Top 15 Business Process Management Software to Consider for 2025

- A Thorough Guide to Business Process Automation

- What is Business Process Modeling and How to Implement it?

- Understanding the Need for BPM Solutions for Successful Business Operations

- 9 Essential BPM Suite Features You Can’t Ignore

- What is a BPM Platform? A Complete Guide to Business Process Management in 2025

- Everything You Need To Know About Business Process Management Services

What should you do next?

Thanks for reading till the end. Here are 3 ways we can help you automate your business:

Do better workflow automation with Cflow

Create workflows with multiple steps, parallel reviewals. auto approvals, public forms, etc. to save time and cost.

Talk to a workflow expert

Get a 30-min. free consultation with our Workflow expert to optimize your daily tasks.

Get smarter with our workflow resources

Explore our workflow automation blogs, ebooks, and other resources to master workflow automation.