Structured and Efficient Expense Management with Expense Software

Running a business is synonymous with incurring expenses at various stages of business growth. Irrespective of the type and quantum of expenses, business expenses need to be monitored, tracked, and controlled for business success. Continuous tracking and controlling of business expenses ensure that all expenses are accounted for and facilitate better budget management. Expense management encompasses all those systems that a business deploys to process, pay, and audit all expenses initiated by employees.

What is Expense Management?

Ever wondered how businesses keep control over what employees spend on the job? That’s where expense management comes in.

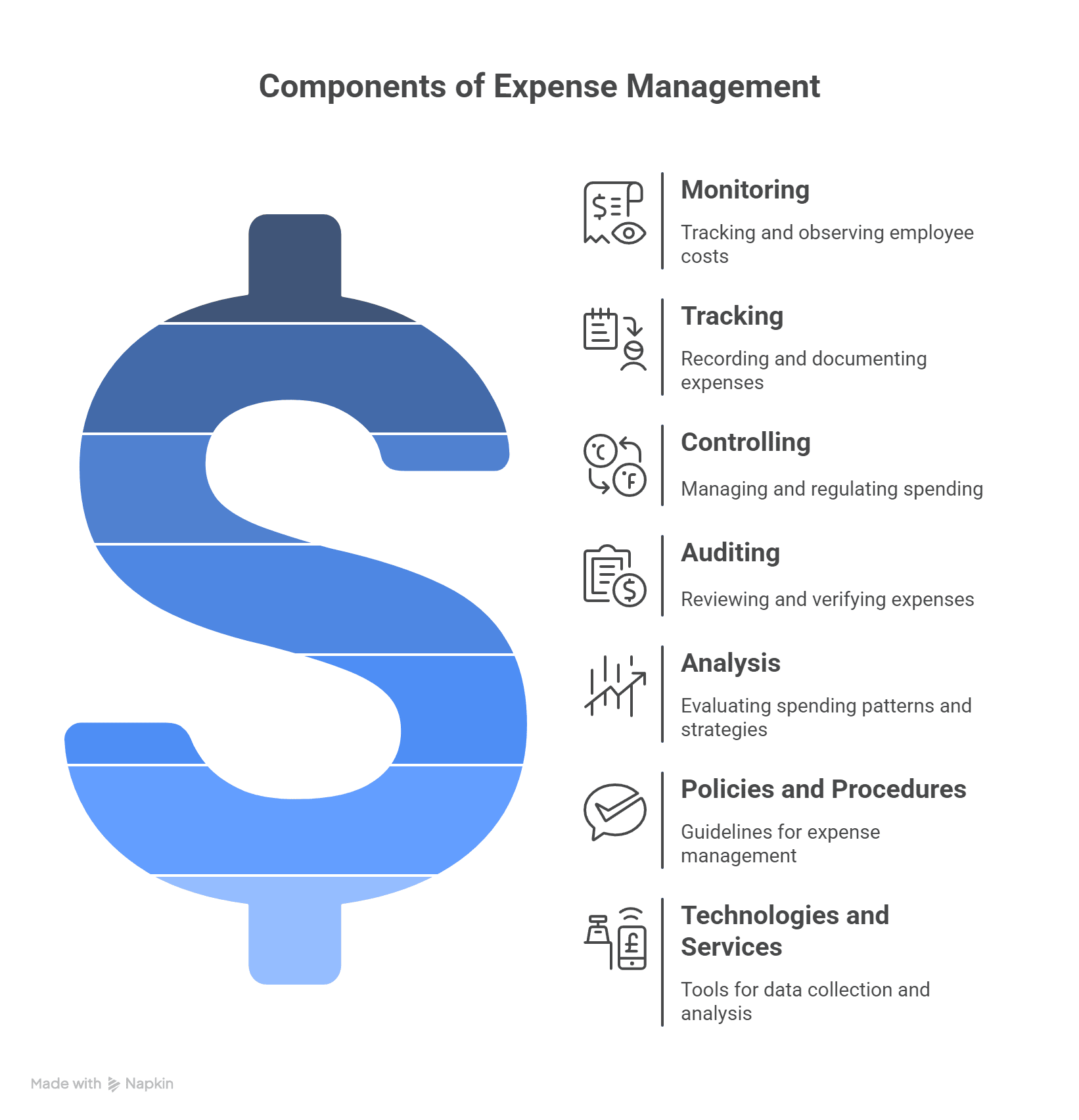

Expense management is the process of monitoring, tracking, and controlling employee spending, as well as reviewing how costs are handled and reimbursed. It covers everything from the policies that govern employee expenses to the tools used to log and analyse spending. In short, it’s how companies ensure every pound spent is accounted for and justified.

Traditionally, this process involved paper receipts, spreadsheets, and manual forms. While this might work for very small businesses, it quickly becomes inefficient and error-prone as the business grows. Relying on manual expense reporting wastes valuable time and opens the door to mistakes, lost receipts, and delayed reimbursements.

But expense management isn’t just about keeping records. It’s also about making sure employees are reimbursed quickly and fairly. When staff travel for work or make purchases on behalf of the business, they expect to be paid back without delays. Smooth, timely reimbursements help boost employee satisfaction and trust.

For any organisation where staff work off-site or travel regularly, a well-defined expense management process is essential. It ensures clear documentation, quick approvals, and hassle-free reimbursements—so teams can stay focused on doing their jobs, not chasing paperwork.

Common Challenges in Expense Management

Archaic expense management systems like paper tracking or spreadsheets are cumbersome and time-consuming. Managers and Finance teams spend their valuable work hours validating claim reimbursement data for the approval of claims.

Here are some common challenges in expense management:

Use of archaic methods:

Archaic expense management methods like paper trails and spreadsheets are labour-intensive, inaccurate, and inconsistent. Poor visibility and transparency over the status of the reimbursement claim is another drawback of archaic expense management methods.

Vague travel policies:

Lack of standardisation in travel policies leads to confusion in the classification of travel expenses as acceptable and non-acceptable. When travel policies are not clearly defined, the likelihood of acceptable expenses being overseen by approvers (reviewers) is high.

Lack of visibility:

Manual claim reimbursement processes do not provide real-time visibility into the status of the claim. Employees and managers are unaware of the latest updates on the claim, which leads to undue delays in claim processing.

Redundant processes:

Steps like the manual entry of data into spreadsheets and the validation of claim data are prone to delays and errors. As a result, reimbursement processing takes a long time and is ineffective.

What are the Different Types of Employee Expenses?

An effective expense management system should be able to handle a wide range of costs incurred by employees across the organisation. Let’s take a closer look at the most common categories:

1. Travel and Expense (T&E)

Business travel is one of the most frequent sources of employee expenses. This includes everything from train fares, flights, and taxis to hotel stays and meals during work trips.

Many staff—especially those in sales or marketing—use their own vehicles for client visits or fieldwork. In such cases, fuel costs and parking charges are typically reimbursed.

Modern T&E systems allow employees to submit travel requests, upload receipts, and get quick approvals from managers. Once approved, the finance team processes the reimbursement, keeping things smooth and accountable.

2. Petty Cash Expenses

Some expenses are too minor to justify a bank transfer or corporate card, like buying stationery, paying for local courier services, or emergency refreshments.

That’s where petty cash comes in. It’s a small amount of cash kept on hand for minor purchases. A good expense system should track how this cash is used to maintain transparency and avoid misuse.

3. Medical Expenses

Many UK businesses offer private health cover or reimbursements for medical costs not fully covered by insurance.

If an employee incurs expenses related to hospital stays, prescriptions, or treatment, they can typically submit a claim for reimbursement, backed by medical bills and other supporting documents.

4. Purchase-Related Expenses

Employees sometimes need to buy tools, software subscriptions, office supplies, or services essential for business operations.

These business purchases are reimbursed after proper documentation, like invoices, proof of payment, and manager approval, is submitted through the expense platform.

A robust expense management solution should support all these categories—from big-ticket travel costs to minor cash payments—making it easier for teams to stay compliant, keep records in order, and reimburse employees on time.

What are the Different Methods of Managing Expenses?

Managing employee expenses doesn’t have to be a headache. From paper receipts to fully automated platforms, there are several ways businesses in the UK handle expense tracking and reimbursements. Here’s a breakdown of the main approaches:

1. Is paper-based expense tracking still used?

Some companies still rely on paper receipts and manual approvals to track expenses. It’s the oldest method—employees collect receipts, attach them to forms, and submit them for manager approval.

But let’s be honest: this method is slow, outdated, and error-prone. Receipts get lost. Approvals get delayed. And reconciling everything takes up hours of admin time. It also opens the door to mistakes and limits visibility into overall spending.

2. Are spreadsheets a better option than paper?

Moving from paper to spreadsheets (like Excel or Google Sheets) is often the first digital step many small businesses take. They’re familiar, flexible, and easy to use for basic tracking.

Spreadsheets can work well for small teams. But once your company grows, or if multiple employees submit regular expense claims, they quickly become difficult to manage. Errors creep in, version control becomes a problem, and there’s little to no audit trail. Spreadsheets also fall short on security, compliance, and transparency.

3. How do expense management platforms make a difference?

This is where modern businesses are heading. Using expense management software transforms how expenses are tracked, approved, and reimbursed.

Here’s how it works:

-

Employees upload receipts digitally.

-

Managers get real-time notifications for approval.

-

Approved expenses are automatically routed to finance for reimbursement.

-

The platform integrates with your payroll, accounting, or ERP systems.

-

Every step is logged, timestamped, and fully auditable.

Platforms provide better control, visibility, and security, making them ideal for companies looking to reduce errors, prevent fraud, and stay compliant with regulations like HMRC requirements or GDPR.

Why does the method matter?

The right expense management method helps your team save time, reduce admin work, and keep employees happy with timely reimbursements. Whether you’re a startup using spreadsheets or a growing company ready for automation, the goal is the same: simplify the process and stay in control of spending.

What is Expense Management Software and Why Does Your Business Need It?

Managing expenses across teams can feel overwhelming, especially without the right tools. That’s where expense management software comes in. It takes the stress out of tracking, approving, and reimbursing business expenses.

Whether you’re a growing startup or a large organisation, having a centralised platform to manage travel, meals, receipts, and other business costs makes the entire process faster, more accurate, and far less painful.

How Does Expense Software Help Your Team?

With the right software in place, your finance team and managers can track claims in real time, approve reimbursements from anywhere, and keep everything in one secure, easy-to-access system.

-

Employees upload digital receipts directly into the system—no more chasing crumpled bits of paper.

-

Managers receive instant notifications when claims are submitted, making approvals quicker and easier.

-

Finance teams stay in control, reviewing all expense activity through a unified dashboard.

It’s not just about saving time—it’s about working smarter.

What Features Should You Expect from a Modern Expense System?

A smart expense management tool goes beyond simple tracking. Here’s what you can expect from a top-tier solution:

-

Cloud-based access – Submit and review claims from anywhere.

-

Mobile apps – Ideal for employees on the move.

-

Automated workflows – Cut out manual approvals and data checks.

-

OCR and receipt scanning – Digitise expense claims quickly.

-

ERP integration – Seamless connection with systems like Sage, Xero, or QuickBooks.

-

Real-time analytics – Get insights into team spending and policy violations.

What Are the Benefits of Using Expense Management Software?

Let’s break it down:

-

Speeds up reimbursements – Claims move faster with automated approvals.

-

Reduces human error – No more manual data entry.

-

Boosts employee satisfaction – No delays, no confusion—just smooth processing.

-

Improves compliance – Audit-ready records make life easier during reviews.

-

Offers complete visibility – From high-level trends to individual claims, every pound is accounted for.

And with digitised receipts, there’s no risk of lost paperwork or incomplete submissions.

Can It Work with Other Systems?

Yes! Most platforms integrate with your existing accounting or ERP software, giving you a more complete view of spending. This means better reporting, better forecasting, and better decision-making.

Whether you use a dedicated receipt management app, a travel expense platform, or a fully integrated expense automation system, the goal is the same: streamline your reimbursement cycle from start to finish.

Why Should You Switch to Automation Now?

If your business is still using spreadsheets or paper forms, you’re wasting valuable hours. Automated expense tools don’t just save time—they give you control, transparency, and insights that manual processes simply can’t match.

With smarter data, you can even spot non-compliant spending before it becomes a costly issue.

What Features Should You Look for in Expense Management Software?

Choosing the right expense management software can make all the difference, especially when it comes to tracking travel expenses, reducing admin time, and speeding up reimbursements. The ideal system isn’t just about submitting claims; it’s about giving your finance team real-time visibility, ensuring policy compliance, and simplifying life for employees on the move.

Let’s break down the key features to look for.

1. Can it be tailored to your business needs?

Every business is different. Your software should be too.

The best systems are fully configurable, letting you adjust fields, rules, and workflows to match your internal policies, such as spending limits or approval hierarchies. This means your expense system grows with you, not against you.

2. Can it adapt to policy changes?

Company spending rules evolve—and your software should keep up.

Whether you’re adjusting travel policies or updating limits, modern expense tools allow you to easily enforce and apply new policies, all without needing custom code or long IT wait times.

3. Does it automatically capture receipts and generate reports?

Say goodbye to lost receipts.

Employees can simply upload a photo or PDF of their receipt, and the software automatically routes it to the right manager. Delayed approvals? They get flagged automatically. You’ll also get automated expense reports that offer valuable insights into spending trends across departments.

4. Does it provide a centralised view of all expense data?

Having all your data in one place is a game-changer.

From claim statuses to receipt histories, everything is accessible through a central dashboard. This helps managers and finance teams stay informed and take action instantly with real-time updates.

5. Is there a mobile app?

Let’s face it—employees don’t sit at desks all day.

With a mobile expense app, staff can track expenses, upload receipts, and submit claims from anywhere. This is ideal for sales teams, consultants, or anyone travelling for work. Plus, it reduces the risk of untracked or missing expenses.

6. Does it support multi-level approvals?

Different teams need different workflows.

Your software should let you customise multi-step approvals based on roles, departments, or project types. Setting up stakeholder approvals shouldn’t require technical know-how—just a few clicks.

7. Can it integrate with other business tools?

The best software doesn’t operate in isolation.

Make sure your expense system integrates with tools like ERP, accounting, HR, and CRM platforms. Even better, if it connects with your travel desk, employees can book travel and claim expenses in one unified workflow.

8. Can it detect policy violations?

Let automation do the policing.

Set rules that flag suspicious claims or overspending before they reach the finance team. This helps you enforce compliance and avoid awkward conversations later.

9. Can it automate reimbursements?

Manually issuing payments? That’s so last decade.

With the right system, once a claim is approved, the software automatically schedules it for reimbursement—no extra admin needed. You can even set up recurring payments or batch approvals to save even more time.

10. Does it work with corporate credit cards?

Many employees rely on company cards for travel and client-related purchases.

When your expense system integrates with corporate credit card feeds, you can auto-match transactions, reduce manual entry, and ensure faster reconciliation. It’s all about making expenses as frictionless as possible.

Why Choose a SaaS-Based Expense Management Solution?

Cloud-based (SaaS) expense systems are preferred by businesses of all sizes. Why?

-

Low setup costs

-

Quick onboarding

-

Access from anywhere

-

No lengthy installations

They also offer real-time updates, regular improvements, and scalability that grows with your company.

Can Cflow Help Automate This?

Absolutely.

Cflow is a cloud-based workflow automation platform that can automate everything from invoice approvals and expense claims to HR and finance processes, with no coding required. With its visual form builder, anyone in your team can create a workflow in minutes, customised to your exact business needs.

What’s the Best Expense Management Software for 2025?

Managing expenses in today’s fast-moving business environment is no longer optional—it’s essential. From eliminating paperwork to gaining real-time insight into employee spending, the right expense management software makes all the difference.

In 2025, top-rated tools offer automation, integration, mobile access, and AI-powered insights to streamline everything from expense report submission to reimbursement. According to Gartner, here’s a list of the leading platforms helping UK businesses take control of their spend.

Which Expense Management Tools Made the Top 10 in 2025?

Here’s a quick look at the best solutions and why they stand out:

1. Cflow

Cflow is a standout choice for growing businesses that want to automate their expense claims without overcomplicating the process. It transforms manual workflows into streamlined, digital approvals, giving teams more time and less paperwork.

-

Best for: SMEs looking for a cloud-based, no-code solution.

-

Key features: Visual form builder, multi-level approvals, seamless tracking, and real-time reporting.

-

Why it works: Perfect for automating reimbursement workflows, finance approvals, and more—all in one place.

2. Expensify by Expensify

Expensify offers a full-featured platform that scales well for enterprise needs. It’s particularly effective for businesses with complex integration requirements.

-

Best for: Large organisations with global expense policies.

-

Strength: Easy uploading of receipts, smart categorisation, and auto-approval flows.

-

Bonus: Its AI-driven tracking makes staying compliant effortless.

3. Zoho Expense

Known for its sleek mobile experience and ease of use, Zoho Expense is ideal for teams that want flexibility and intuitive design.

-

Best for: Companies already using Zoho’s suite or needing strong mobile functionality.

-

Highlights: Custom approvals, mileage tracking, and international currency support.

4. ExpensePoint by ExpensePoint

ExpensePoint gives managers clear visibility into how money flows through the organisation.

-

Best for: Mid-sized businesses seeking data-backed decision-making.

-

Strengths: Smart dashboards, real-time status updates, and flexible approval routing.

5. Emburse Certify

If your team is on the move, Certify is built to make mobile expense reporting painless.

-

Best for: Teams needing mobile-first expense management.

-

Features: Snap, submit, and approve on the go.

-

Bonus: Strong compliance tools and policy enforcement built-in.

6. Brex

Brex is tailor-made for start-ups and scale-ups. With the added benefit of virtual and physical cards, it brings expense management and corporate spending together.

-

Best for: Fast-growing UK start-ups.

-

USP: Smart controls, built-in reward points, and real-time notifications.

7. Emburse Nexonia

Ideal for businesses with credit card-heavy usage, Nexonia makes reconciling card expenses far more efficient.

-

Best for: Organisations managing high volumes of credit card transactions.

-

Edge: Strong integration with finance systems.

8. Rydoo

Rydoo is a flexible, cloud-based platform that helps global teams manage travel expenses efficiently.

-

Best for: Companies with international teams.

-

Benefits: Multi-currency support, OCR scanning, and ERP integrations.

9. Emburse Abacus

Designed for simplicity, Abacus is perfect for teams looking to automate policy enforcement and speed up approvals.

-

Best for: Teams that value custom automation rules.

-

Highlight: Easy claim creation and real-time manager alerts.

10. Webexpenses

UK-based Webexpenses offers a solid option for businesses that need a smooth, fast rollout.

-

Best for: Companies focused on ease of deployment.

-

Perks: Great for tracking travel claims and policy compliance.

How Do You Choose the Right Tool?

Each of these platforms offers unique benefits, so your choice should reflect:

-

Your business size and growth stage

-

The complexity of your approval workflows

-

Whether your team works on-site, hybrid, or remotely

-

The level of integration needed with existing finance or HR systems

If you’re looking for a system that balances simplicity, flexibility, and affordability, Cflow is a top choice, especially for SMEs and mid-sized businesses in the UK.

Final Thought: Why Automate Now?

Still relying on spreadsheets or paper receipts? That’s a recipe for lost claims, duplicate entries, and slow approvals. Modern businesses are moving to automated platforms to:

-

Save time on manual entries

-

Catch duplicate or non-compliant claims

-

Get real-time visibility into spending

-

Speed up reimbursements and approvals

Why Cflow is the Smart Choice for UK Businesses

Cflow gives you everything you need in one cloud-based platform:

-

Visual workflow builder—no coding required

-

Multi-level approvals and policy enforcement

-

Mobile access and real-time insights

-

Easy integration with finance and HR systems

Want to see it in action?

Try Cflow free for 14 days and start automating your expense claims today.