AI Workflow Automation: Achieving Compliance Without Slowing Innovation

Key takeaways

- AI workflow automation offers significant operational advantages, but UK businesses must align these systems with regulations like UK GDPR, the Equality Act 2010, and FCA guidelines to stay compliant.

- Top compliance risks—including data misuse, lack of explainability, algorithmic bias, missing audit trails, and regulatory lag—can derail automation initiatives if not proactively managed.

- Building compliance-first AI workflows requires key safeguards like Human-in-the-Loop oversight, role-based access controls, consent tracking, audit logging, and fairness testing to mitigate legal and ethical risks.

- Real-world examples from fintech, healthcare, and legal sectors show how UK companies are using Cflow to streamline workflows while maintaining strict regulatory compliance and audit-readiness.

- The future of AI compliance in the UK points toward predictive compliance tools, ESG automation, cross-border governance, and explainable AI becoming industry standards.

- Cflow empowers UK businesses with compliance-ready workflow tools—including visual workflow builders, audit trails, industry-specific templates, and built-in risk controls—for confident, regulation-aligned automation.

In a world sprinting toward automation, UK companies face a delicate question:

Can we accelerate workflows with AI without violating the very laws that keep us ethical and accountable?

Spoiler: Yes, but it takes more than plugging in a fancy tool.

Welcome to the new frontier of business compliance, where AI doesn’t just optimise how you work—it rewrites the rules. For UK businesses under the gaze of GDPR watchdogs, FCA regulators, and the ICO’s evolving AI guidance, the stakes have never been higher. It’s not enough to automate; you have to automate responsibly.

What Is AI Workflow Automation?

AI workflow automation refers to the use of artificial intelligence to manage, monitor, and optimise end-to-end business processes. Unlike traditional automation that follows rigid rules, AI-driven workflows learn patterns, make data-informed decisions, and adapt over time.

Examples include:

- Automatically routing expense claims for approval based on amount and policy compliance.

- Scanning legal contracts and flagging clauses that violate internal or legal standards.

- Detecting anomalies in financial transactions and triggering fraud checks.

In the UK, the push toward automation is driven by:

- Labour shortages

- Remote workforce challenges

- Demand for real-time compliance updates

According to a Deloitte UK survey conducted in October 2024, 95% of large businesses plan to increase investment in digital technologies like AI, highlighting a strong commitment to enhancing operational efficiency.

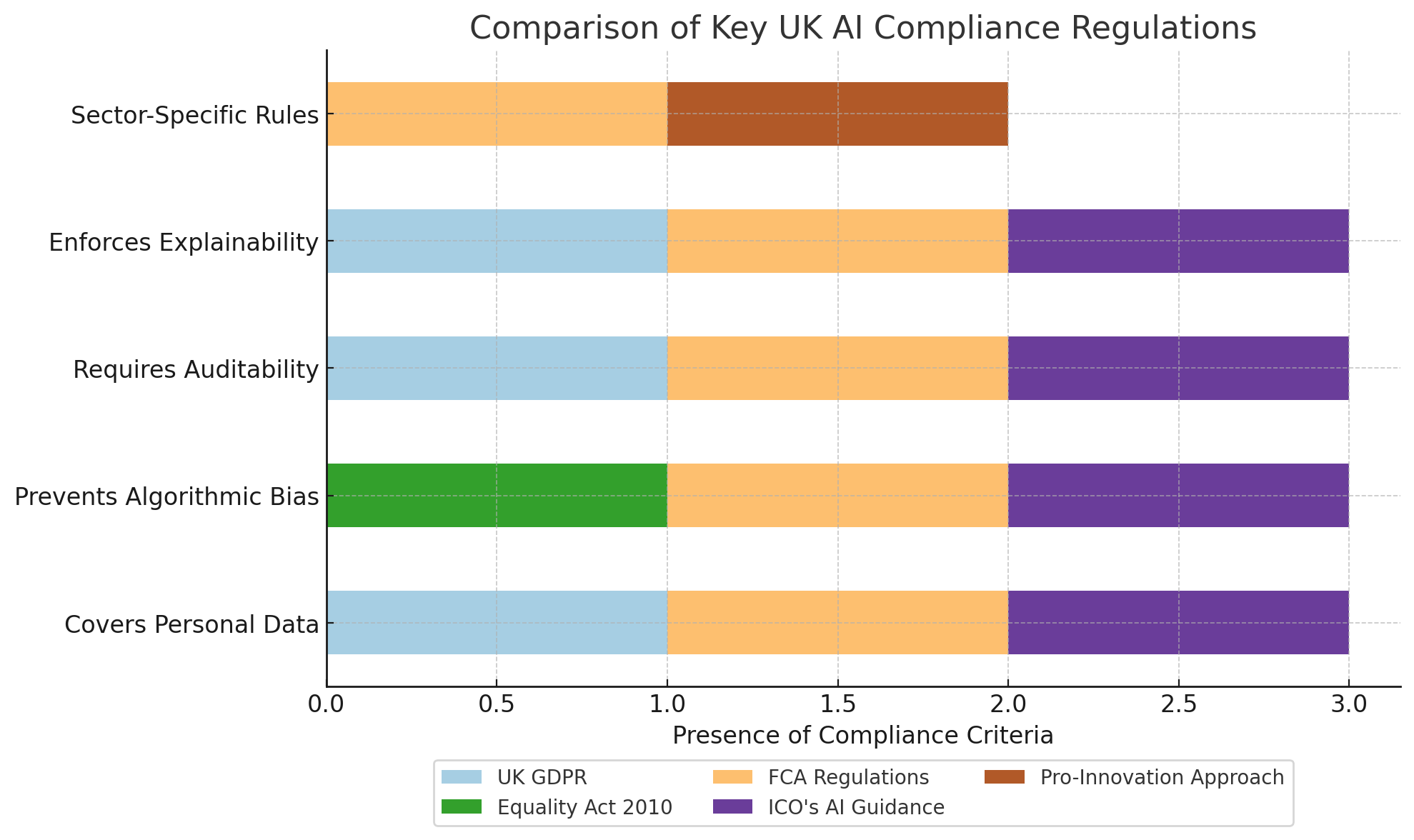

What Are the Key Compliance Regulations in the UK?

Before jumping into automation, it’s vital to understand the regulatory foundations that govern digital operations in the UK. Here are the primary regulations and initiatives every UK business should understand:

1. UK GDPR

The United Kingdom General Data Protection Regulation (UK GDPR) governs how businesses process personal data. It applies to any organisation that handles UK citizens’ data, regardless of where that organisation is based.

Key requirements include:

- Obtaining clear and explicit consent before processing personal data.

- Ensuring data minimisation, accuracy, and security.

- Allowing data subjects to access, correct, or erase their data.

- Providing transparency about how AI-driven decisions are made.

- Implementing human oversight for automated decisions that significantly affect individuals (e.g., credit approvals, hiring decisions).

Failing to comply can result in significant fines—up to £17.5 million or 4% of annual global turnover.

2. Equality Act 2010

This law prohibits discrimination based on protected characteristics such as age, gender, race, disability, and religion. For AI workflows, this means:

- Ensuring that algorithms used in decision-making do not produce biased outcomes.

- Regular audits to detect and correct any signs of algorithmic discrimination.

- Transparent documentation showing how fairness and inclusivity are built into workflow automation.

3. Financial Conduct Authority (FCA)

The FCA regulates financial institutions in the UK and has increasing oversight over digital transformation and AI use in the finance sector. Its expectations include:

- AI systems must be explainable and not act as “black boxes.”

- Workflows involving financial decision-making must have clear audit trails.

- Credit scoring and risk assessments must be traceable, fair, and adjustable.

- Companies should maintain accountability structures, including designated compliance personnel overseeing AI deployments.

4. ICO’s AI Guidance

The Information Commissioner’s Office (ICO) has published dedicated guidance on AI and data protection. The goal is to ensure AI systems uphold fairness, transparency, and accountability. Key points include:

- Limiting the use of AI in high-risk contexts without appropriate safeguards.

- Providing meaningful information about the logic involved in automated decisions.

- Establishing governance frameworks to monitor AI performance and data use.

- Documenting all processes to demonstrate compliance during audits or investigations.

5. UK Government’s Pro-Innovation Approach

Rather than a single AI regulator, the UK follows a “pro-innovation” regulatory strategy. This approach gives sector-specific regulators the power to enforce AI rules within their industries. Implications include:

- More flexibility for businesses to innovate with AI while staying within their sector’s boundaries.

- Greater responsibility is placed on businesses to conduct risk assessments, maintain documentation, and implement safety nets for AI misuse.

- Potential for future legislation as AI adoption expands and matures.

This decentralised model aims to strike a balance: enabling innovation without compromising on ethical and legal standards. The UK does not currently have a central AI regulator. Instead, it encourages sector-specific bodies to apply their own rules. This gives companies more flexibility but also more responsibility.

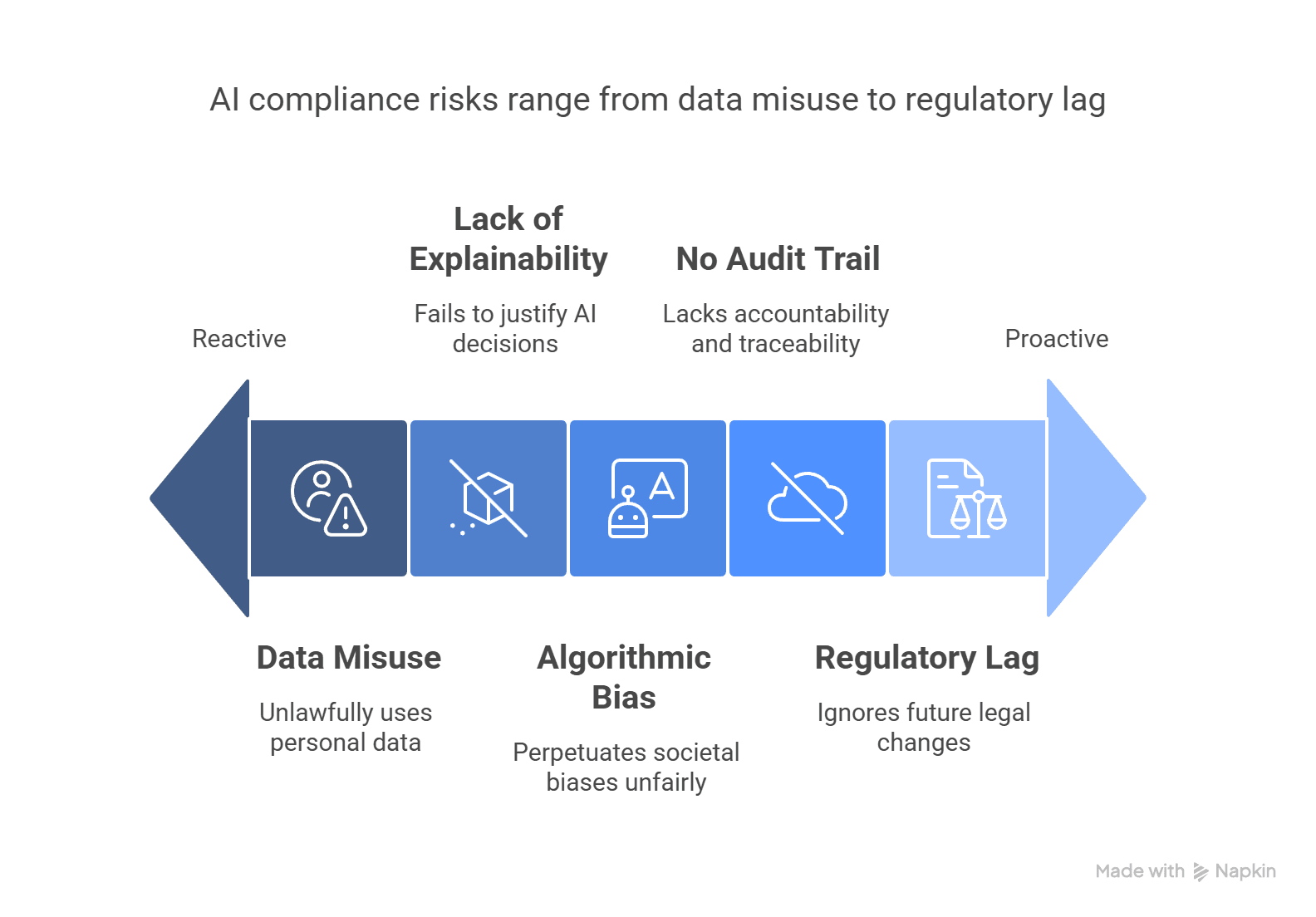

Top 5 Compliance Risks in AI Workflow Automation

AI brings immense benefits, but it also opens the door to serious compliance risks—especially if safeguards aren’t built into your workflow architecture. Here are the five biggest threats businesses must address:

1. Data Misuse

AI systems often require large volumes of data to function effectively. But when that data includes personal information—names, contact details, medical records, financial transactions—businesses are bound by data protection laws like UK GDPR.

Risks include:

- Collecting or processing data without informed user consent.

- Storing data in unsecured environments.

- Using personal data for purposes not originally disclosed.

Consequences: Massive fines, criminal liability, loss of consumer trust, and legal proceedings. In 2023, several UK firms were penalised for data misuse in AI-based marketing tools.

2. Lack of Explainability

Black-box AI systems can deliver fast decisions, but when those decisions affect real people (loan rejections, job applications, policy approvals), businesses must explain how they were made.

Risks include:

- Deploying models that can’t justify outcomes.

- Failing to offer appeal or review processes for affected users.

- Violating transparency principles required by regulators.

Consequences: ICO investigations, class-action lawsuits, and erosion of user confidence. Explainability isn’t just an ethical concern—it’s a legal one in regulated sectors.

3. Bias in Algorithms

AI can inherit the biases of its training data. If your workflow is built on historical records that reflect gender, racial, or socio-economic bias, it will likely reproduce and magnify those injustices.

Risks include:

- Discriminatory hiring, lending, or insurance workflows.

- Negative media coverage and brand damage.

- Breach of the Equality Act 2010.

Consequences: Public backlash, lawsuits, and penalties. Regular fairness audits and bias testing are essential.

4. No Audit Trail

Regulatory bodies want accountability. Every action taken by a workflow—whether by a human or an AI agent—should be logged, timestamped, and retrievable.

Risks include:

- Inability to show who approved what and when.

- Disorganised or missing logs during compliance audits.

- Inconsistent documentation of decision-making logic.

Consequences: Failed audits, compliance violations, and loss of regulatory licenses. Audit trails are not optional—they’re your compliance safety net.

5. Regulatory Lag

AI technology moves fast. Regulation moves slowly. This mismatch creates ambiguity and increases the risk of accidentally stepping over a legal line.

Risks include:

- Assuming your AI practices are compliant simply because laws haven’t caught up.

- Launching workflows without understanding pending regulatory reforms.

- Ignoring ethical considerations in pursuit of speed.

Consequences: Being caught off-guard by sudden changes, retroactive penalties, and reputational damage. The best defence is proactive governance and ongoing legal monitoring.

These risks aren’t theoretical—they’re happening right now. Addressing them head-on is the only way to harness AI safely and responsibly in a regulated UK business environment. AI technology evolves faster than laws. Staying on the right side of compliance means anticipating changes, not just reacting to them.

How to Build Compliance-First AI Workflows

To design AI workflows that won’t get you into trouble, it’s essential to bake compliance into every layer of the system—from logic and decision rules to user interfaces and approvals.

- Human-in-the-Loop (HITL)

Not every decision should be left to an algorithm. High-stakes decisions—like contract approvals, fraud detection, or regulatory escalations—require human intervention. Implement workflows where AI flags issues, but a person makes the final call. This ensures accountability and builds a layer of ethical review into automation. - Role-Based Access Controls (RBAC)

Not all data should be visible to every employee. Use RBAC to restrict sensitive information access based on job roles, clearance levels, or department. AI workflows must recognise and enforce these boundaries so no one oversteps their access privileges unintentionally. - Consent Management Systems

Consent isn’t just a checkbox—it’s a living record. Every time personal data enters a system, your AI workflow should capture:- Who gave consent

- What they consented to

- When and how consent was given

- How users can revoke it later

- These records should be visible, auditable, and easy to modify or revoke.

- Real-Time Audit Logging

Compliance isn’t just about being right—it’s about proving you were right. Every automated step, user interaction, or AI-generated decision must be logged:- What action occurred

- Who initiated it

- What data it involved

- What outcome was reached

- This trail is critical for regulatory reviews, internal investigations, or external audits.

- Bias and Fairness Audits

AI systems trained on historical data may perpetuate bias unless checked. Embed fairness checkpoints in your workflow:- Use fairness metrics to test outcomes across groups

- Rebalance datasets before training

- Run post-deployment fairness audits regularly

- Transparency in your model design and performance can help build trust while staying on the right side of the Equality Act and other fairness standards.

End-to-end workflow automation

Build fully-customizable, no code process workflows in a jiffy.

Real-World Examples

Fintech in London

A UK-based challenger bank revolutionised its credit risk assessment process using AI workflow automation. The system evaluates incoming loan applications in real time by cross-referencing applicant data with predefined risk metrics and open banking records. A transparent approval matrix ensures that high-risk applications are flagged for manual review. Cflow’s audit log tracks every approval and action, helping the bank meet strict FCA requirements for traceability and explainability.

Results:

- Reduced processing time by 60%

- Passed two consecutive FCA compliance audits with zero major flags

- Improved customer satisfaction with faster decision-making.

NHS Healthcare Trust

One of the UK’s largest NHS trusts adopted AI to streamline patient referral management. Incoming referral forms are digitised, categorised, and routed automatically to the correct departments. Cflow’s integration with internal databases enables secure access and anonymisation of patient data, aligning with NHS Digital and ICO standards. Compliance officers regularly audit the workflow to ensure continued alignment with data protection regulations.

Results:

- Referral processing time cut from 3 days to under 12 hours

- Full compliance with NHS data governance protocols

- Zero data breach incidents since implementation.

Legal Services Firm in Manchester

A top-tier legal firm partnered with Cflow to overhaul its contract lifecycle management. Using AI-driven natural language processing (NLP), the workflow scans and flags potentially risky or non-standard clauses. Each contract version is stored with full change history, and approvals are routed through a defined hierarchy. The firm complies fully with the Solicitors Regulation Authority (SRA) guidelines by maintaining transparency and accountability at each stage.

Results:

- Reduced contract review time by 45%

- Enabled legal teams to focus on complex negotiations rather than manual review

- Built a defensible audit trail for every contract-related action

Where It’s Going: The Future of AI Compliance in the UK

The UK’s flexible approach to AI regulation encourages innovation while asking businesses to self-regulate and maintain ethical boundaries. As AI adoption deepens, the compliance landscape is rapidly evolving. Here’s a glimpse into what lies ahead:

- Predictive Compliance Tools

Advanced AI systems will not just flag violations—they’ll anticipate them. These tools will proactively identify gaps in workflows, detect policy conflicts, and recommend real-time adjustments before breaches occur. This predictive layer will act as a digital compliance officer embedded into every process. - ESG Reporting Automation

Environmental, Social, and Governance (ESG) reporting is becoming a boardroom priority. AI can simplify this process by automating the collection, validation, and presentation of ESG data. For example, companies can use AI to track emissions, supplier ethics, or diversity metrics, and generate regulatory reports without manual effort. - Cross-border Data Governance

As UK businesses operate globally, they must comply with data laws from multiple jurisdictions, such as the EU’s GDPR, the US’s CCPA, and sector-specific regulations in Asia. AI-powered governance tools will map data flows, apply the correct jurisdictional rules, and help maintain compliance across borders. - Explainable AI (XAI)

Regulatory frameworks are beginning to demand that AI systems provide clear, human-understandable explanations for their decisions. XAI will become a standard requirement, especially in sectors like finance, healthcare, and law. Businesses will shift toward AI models that provide transparency without sacrificing performance. - AI Ethics and Governance Frameworks

Organisations will start embedding ethical AI boards, creating internal governance policies, and issuing public AI usage charters. These efforts will not only help maintain regulatory compliance but also boost public trust. - Regulatory Sandboxes and Real-time Auditing

The UK’s sandbox model will continue to evolve, allowing companies to test AI solutions in controlled environments. Meanwhile, regulators may implement AI-driven real-time monitoring to flag violations dynamically instead of relying solely on annual audits.

Staying ahead of these trends means investing not just in technology, but in culture, policy, and ethical design. UK companies that move early will lead the charge into the next era of responsible AI.

Getting Started with Cflow

Cflow is more than just workflow software—it’s your compliance co-pilot. Built with a deep understanding of regulatory needs, Cflow helps organisations in the UK stay ahead of audits, approvals, and accountability. Here’s how it simplifies compliance-driven automation:

- Visual Workflow Builder

Design every business process visually, breaking it down into manageable steps. Add compliance checkpoints, define multi-level approval hierarchies, and insert mandatory verification stages. This ensures your AI workflows are as thorough as your regulatory environment demands. - Drag-and-Drop Form Designer

Need to collect data securely and legally? With Cflow’s intuitive form builder, you can add GDPR-compliant fields, create digital signature sections, and embed consent checkboxes—all without writing a single line of code. - Audit Trails & Logs

Every task, decision, and AI action is time-stamped and stored. Whether it’s an employee submitting a request or AI flagging a risk, Cflow logs every touchpoint. This is essential for audit-readiness and demonstrates transparency to regulatory bodies. - Customisable Workflows by Industry

Different industries face different regulations. Cflow allows you to tailor workflows for finance (FCA), healthcare (NHS/ICO), legal (SRA), and more. Templates and rules can be adjusted to match evolving compliance demands, without disrupting operations. - Built-In Risk Mitigation Tools

Use conditional logic, escalation rules, and alerts to flag non-compliant actions or delayed approvals. This enables proactive compliance and prevents small errors from becoming regulatory liabilities. - Scalable and Secure

Whether you’re automating a single department or enterprise-wide processes, Cflow offers enterprise-grade security, encryption, and role-based access control to protect sensitive data at scale.

Cflow gives you the power to automate with confidence—no blind spots, no guesswork, just smart compliance baked into every workflow layer.

FAQs

Can AI workflows be GDPR compliant in the UK?

Yes, if they include transparency, consent capture, access control, and clear audit trails.

What sectors benefit most from AI compliance automation?

Finance, healthcare, law, government—anywhere that deals with personal data and regulatory scrutiny.

Is there a UK-specific AI compliance law?

Not currently, but sector-specific guidance from the ICO and the FCA plays a regulatory role.

How can businesses ensure their AI workflows remain compliant over time?

Regular audits, updates to align with new laws, and a workflow platform like Cflow that evolves with you.

Thanks for reading till the end. Here are 3 ways we can help you automate your business: Create workflows with multiple steps, parallel reviewals. auto approvals, public forms,

etc. to save time and cost. Get a 30-min. free consultation with our Workflow expert to optimize

your daily tasks. Explore our workflow automation blogs, ebooks, and other resources to master

workflow automation.What should you do next?

Do better workflow automation with Cflow

Talk to a workflow expert

Get smarter with our workflow resources

Get Your Workflows Automated for Free!