AI Workflow Automation in Finance and Accounting: A Complete Guide

Key takeaways

- UK finance teams are adopting AI-powered workflow automation to eliminate bottlenecks, reduce manual errors, and ensure faster, more compliant processes.

- AI enhances core finance functions like invoice processing, reimbursements, reporting, and budgeting—leading to improved accuracy, visibility, and decision-making.

- No-code platforms like Cflow enable accounting teams to automate without developer support, boosting productivity while reducing operational costs.

- Starting with automated workflows—like invoice approvals or expense claims—delivers quick efficiency wins and sets the stage for scalable digital transformation.

Introduction: The New Era of Finance Automation

For decades, finance departments have operated like quiet engines—reliable but riddled with inefficiencies. The sheer weight of manual data entry, spreadsheet juggling, and slow approval chains has long held back their potential. But we’ve hit an inflexion point. Welcome to the era where AI isn’t just disrupting finance—it’s reprogramming it.

In traditional accounting and finance teams, even simple tasks like invoice approval or reimbursement processing can spiral into email threads, missed deadlines, and audit nightmares. Financial reporting still leans heavily on human validation, which means errors are not only common—they’re costly. Add the burden of compliance and the pressure to scale operations, and it’s no wonder CFOs are desperate for change.

That’s where AI workflow automation steps in—not as a patch, but as a paradigm shift. By combining intelligent automation with a no-code framework, businesses can now eliminate repetitive tasks, build smart approval flows, and tap into real-time analytics without writing a single line of code. This isn’t about replacing humans. It’s about giving finance teams the digital muscle to focus on what matters—insights, strategy, and performance.

And tools like Cflow are at the heart of this shift. Purpose-built for finance and accounting workflows, Cflow offers AI-powered automation through a visual, drag-and-drop interface. It’s no-code, but it’s powerful. It’s smart, but it’s simple. And above all, it’s built for finance professionals who are done playing catch-up with legacy systems.

In the UK, finance teams are navigating mounting pressure—from post-Brexit regulation to ESG mandates and Making Tax Digital (MTD) compliance. AI-driven workflow automation isn’t just an innovation here—it’s a competitive edge.

In the next sections, we’ll break down what AI workflow automation means for finance, why it’s critical now, and how platforms like Cflow are reshaping the financial core of modern enterprises.

What is AI Workflow Automation in Finance and Accounting?

AI workflow automation in finance isn’t just a buzzword—it’s the silent revolution redefining how money moves through a company. At its core, it’s the use of artificial intelligence to design, execute, and optimise financial processes with minimal human intervention. But here’s the twist: unlike standard automation, AI brings a brain to the brawn. It doesn’t just “do”—it learns, predicts, and adapts.

Let’s unpack that.

Traditional automation follows strict rules—“If A, then B.” It’s great for repetitive tasks, but crumbles under complexity. AI-powered automation, on the other hand, interprets data, understands anomalies, and evolves with every workflow. It spots patterns. It predicts delays. It even flags compliance risks before they blow up into full-blown audits.

Nowhere is this more relevant than in the financial trenches. Think about accounts payable. AI can extract invoice data using OCR, verify vendor details through lookups, and trigger approvals based on thresholds. For accounts receivable, it can track ageing reports and initiate follow-ups. In reconciliation, it auto-matches records, flags discrepancies, and escalates exceptions. And for reporting? AI aggregates, formats, and delivers financial insights faster than any Excel wizard ever could.

Here’s where Cflow redefines the game: it takes this powerful AI logic and packages it into a no-code, visual platform. That means finance teams don’t need IT tickets or consultants to build intelligent workflows. They can drag, drop, configure, and launch on their terms.

AI workflow automation is no longer a luxury—it’s the foundation of competitive finance. And for teams willing to embrace it, the benefits are not just operational—they’re transformational. Let’s see why finance teams can’t afford to ignore this any longer.

Many UK businesses, especially SMEs, are already leveraging AI workflow platforms to comply with HMRC digital record-keeping, while improving invoice and expense efficiency.

Did You Know?

The UK Government’s Making Tax Digital initiative mandates real-time record-keeping, making AI-powered reporting tools essential for compliance.

Source: HMRC – Making Tax Digital for VAT

Why Finance Teams Need AI Workflow Automation

Finance is fast-paced, but the systems behind it often move like molasses. It’s not just about numbers anymore—it’s about speed, precision, and agility. That’s exactly what AI workflow automation delivers. Here’s how it changes the game for finance teams.

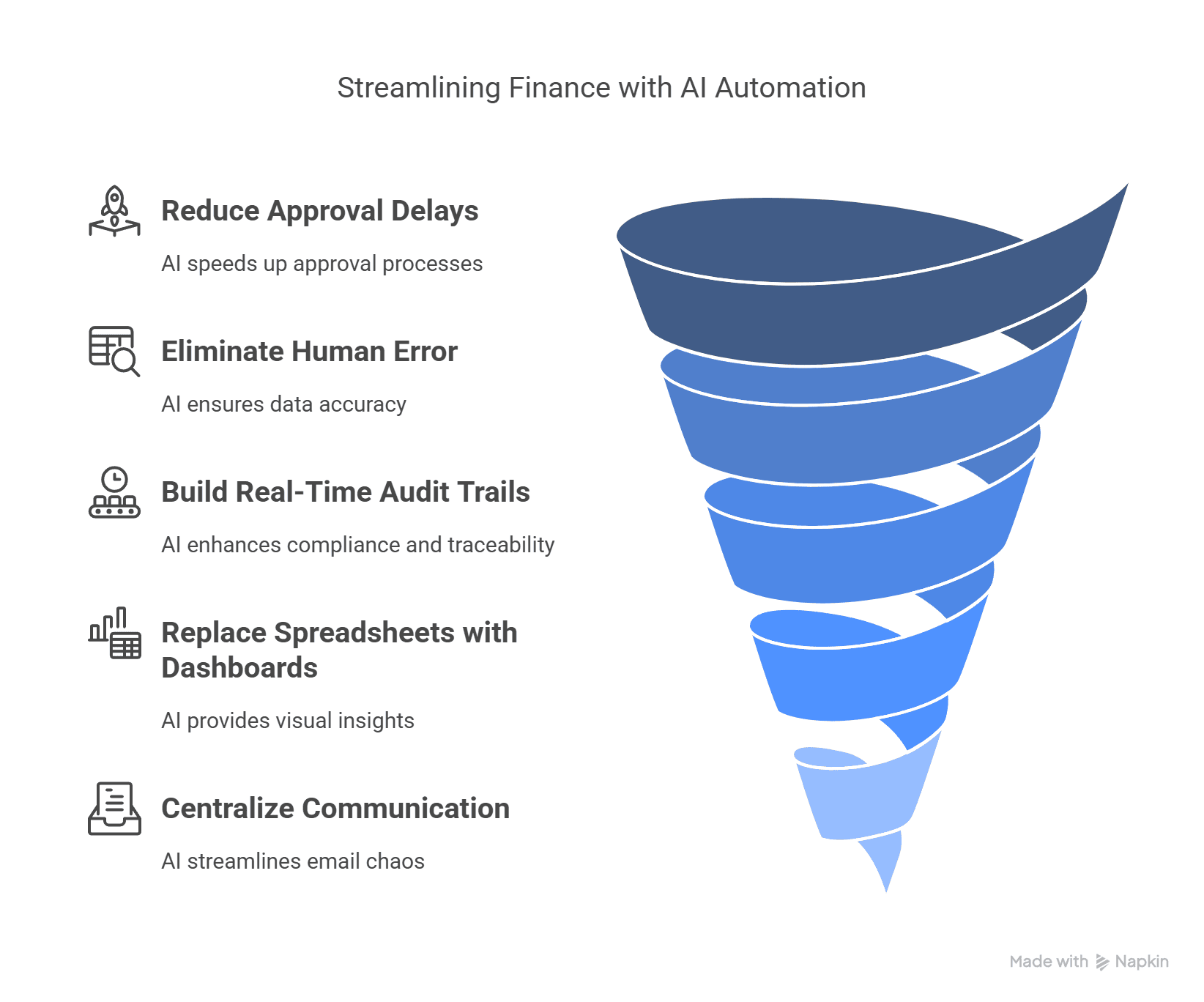

- It slashes approval delays.

Every day spent waiting for an invoice or budget request to be approved is a day lost in execution. With AI-powered workflows, approvals can be triggered instantly based on pre-set conditions—no need to chase stakeholders. Add Cflow’s approval via email and no-login reviews, and bottlenecks vanish. - It kills human error.

Manual data entry isn’t just inefficient—it’s risky. A single wrong digit can derail financial reports. With Cflow’s OCR and lookup validations, data is auto-extracted and cross-checked, reducing inaccuracies that would otherwise slip through the cracks. - It builds audit trails in real-time.

Compliance isn’t optional—it’s mission-critical. Cflow’s workflow history, document versioning, and business activity monitor ensure that every step is traceable, timestamped, and audit-ready, without lifting a finger. - It replaces spreadsheets with dashboards.

Why drown in rows and columns when you can fly with visual insights? Cflow’s custom reports and Power BI integration help finance leaders monitor trends, track KPIs, and make decisions based on live data, not yesterday’s exports. - It liberates teams from email chaos.

Too many finance processes still live in inboxes. With dynamic workflows, conditional logic, and reminders, everything from reimbursements to reconciliations gets centralised, automated, and scalable.

The bottom line? Finance teams don’t just need AI workflow automation—they need it now. And as we’ll see next, Cflow is already transforming the finance function in powerful, practical ways.

Key Finance Functions Transformed by Cflow

AI workflow automation isn’t just theoretical—it’s already reshaping the financial core of businesses. With Cflow, finance teams gain access to a visual, no-code platform armed with powerful AI features that map directly to everyday pain points. Let’s explore four finance functions that are being revolutionised, one workflow at a time.

1. Invoice Approval and Accounts Payable Automation

Manual invoice processing is a black hole of time and errors. From missing paperwork to delayed sign-offs, it’s ripe for automation.

Cflow features that make it seamless:

- Visual Workflow Designer: Build custom approval paths with drag-and-drop ease.

- Approval via Email or Without Login: Stakeholders don’t need a Cflow account to approve—just click and go.

- Attach Documents with Emails: Vendors send invoices; Cflow routes them instantly.

- Conditional Mandatory Fields: Ensure data like invoice number or vendor ID is never skipped.

- Fuzzy Search: Flag near-duplicate invoices before they cause double payments.

- OCR Integration: Auto-extract line items from PDFs and scanned invoices.

- Email Escalation and Reminders: No more “lost in inbox” excuses.

The result? Invoices move from received to approved in hours, not days.

2. Expense Reimbursement and Claims Management

Employee reimbursements are often delayed by missing receipts, wrong formats, or unclear policies. Cflow turns chaos into clarity.

Cflow features that simplify reimbursement workflows:

- Predefined Templates: Use ready-to-go forms to get started in minutes.

- Lookup Fields: Auto-fill employee and department data from databases.

- Amount in Words Conversion: Adds legal clarity to high-value claims.

- Attachment Mandatory Check: No receipt? No submission.

- Document Designer: Customise claim vouchers with your branding.

- Excel Import/Export: Manage claims in bulk for end-of-month wrap-ups.

Reimbursements become swift, policy-compliant, and frustration-free.

3. Financial Reporting and Audit Readiness

Crunching numbers is only half the battle—packaging them for insight and compliance is the other. Cflow makes both effortless.

Key features that elevate reporting:

- Dashboard, Table, and Custom Reports: Build views tailored to finance KPIs.

- Export to Excel, PDF, or CSV: Share insights in the format stakeholders prefer.

- Automated Report Sharing via Email: Keep decision-makers informed—on time, every time.

- Business Activity Monitor: Track who did what and when, across all processes.

- Power BI Integration: Turn workflows into data-rich visuals for real-time analysis.

- Scheduled Workflow Backups: Ensure no data is ever lost in a crash

Your finance team moves from being reactive to data-driven.

4. Budget Approvals and Capital Expenditure (CapEx) Workflows

Big spends require even bigger accountability. With Cflow, multi-level approvals don’t mean multi-week delays.

Features tailored for complex financial decisions:

- Role-Based Conditional Visibility: Show only relevant data to each approver.

- Time-Based Triggers: Automate quarterly or monthly budget reviews.

- Dynamic Stages: Route requests to the next approver based on the amount or department.

- Approval via Email or Public Forms: External reviewers or CFOs can act without a login.

- Delegation & Bulk Approval: Keep processes flowing even when key stakeholders are unavailable.

Finance becomes fluid, even for the most strategic decisions.

UK businesses spend an average of £9–£15 to process a single invoice manually. With AI workflow automation, the cost drops by nearly 70%.

Source: Ardent Partners UK Finance Insights Report

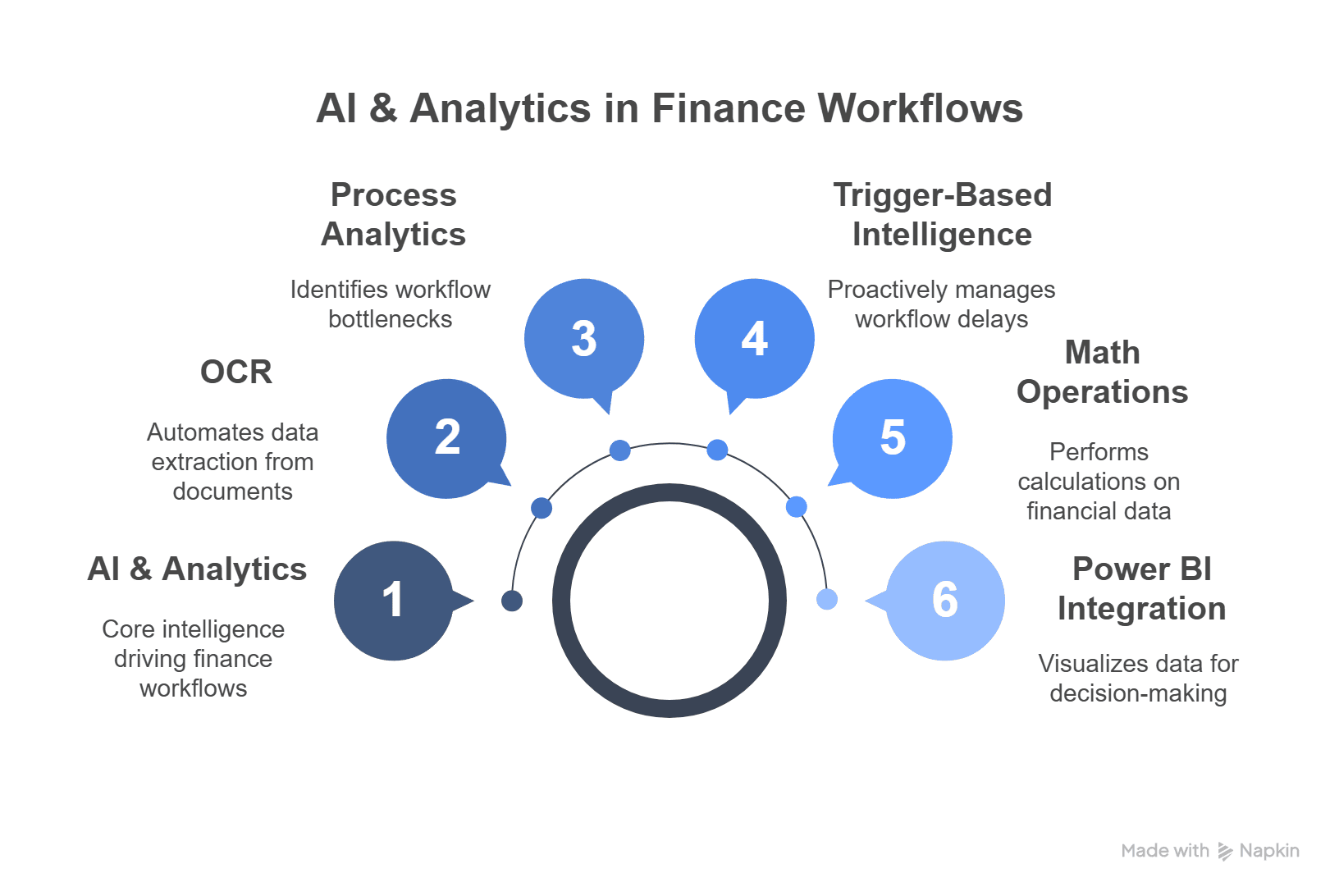

AI & Analytics: Adding Intelligence to Finance Workflows

Automation handles the “how.” AI figures out the “when,” “why,” and “what’s next.” When finance teams integrate intelligent features into their workflows, they gain more than efficiency—they gain foresight. With Cflow, AI doesn’t just move processes—it thinks through them.

Let’s break it down.

OCR: From Paper to Data in Seconds

Manually entering invoice amounts, vendor names, or tax details? Not anymore. Cflow’s OCR (Optical Character Recognition) reads PDFs and scanned documents, instantly pulling key data into workflows. The result? No typos. No missed entries. Just clean, usable data—every time.

Process Analytics: See Where Time Disappears

Finance leaders often ask: Why are we always chasing approvals? Cflow answers with Analytics for Process Owners. Track how long approvals take, where delays happen, and who’s holding things up. Use Business Activity Monitor to visualise patterns and proactively clear the blockages.

Trigger-Based Intelligence: Anticipate the Lag

Why wait for problems to escalate? With time-based triggers, Cflow auto-escalates approvals pending too long or nudges reviewers before SLAs are breached. Conditional logic routes requests based on thresholds, departments, or urgency—no manual routing needed.

Math Operations & Cumulative Calculations

AI doesn’t just move data; it crunches it. Whether you’re totalling budgets, validating reimbursement limits, or aggregating spend categories, Cflow handles it with built-in math ops and cumulative fields—zero formulas, zero friction.

Power BI Integration: Turn Workflows into Dashboards

Why dig through spreadsheets when your workflows can talk to Power BI? Visualise expense trends, CapEx requests, or AP ageing data live, pulling directly from Cflow’s ecosystem. Now, your reports don’t just inform. They make decisions.

With AI and analytics at the core, finance teams no longer just process data—they harness it. And that’s the difference between keeping up and pulling ahead. Up next: making all of this secure.

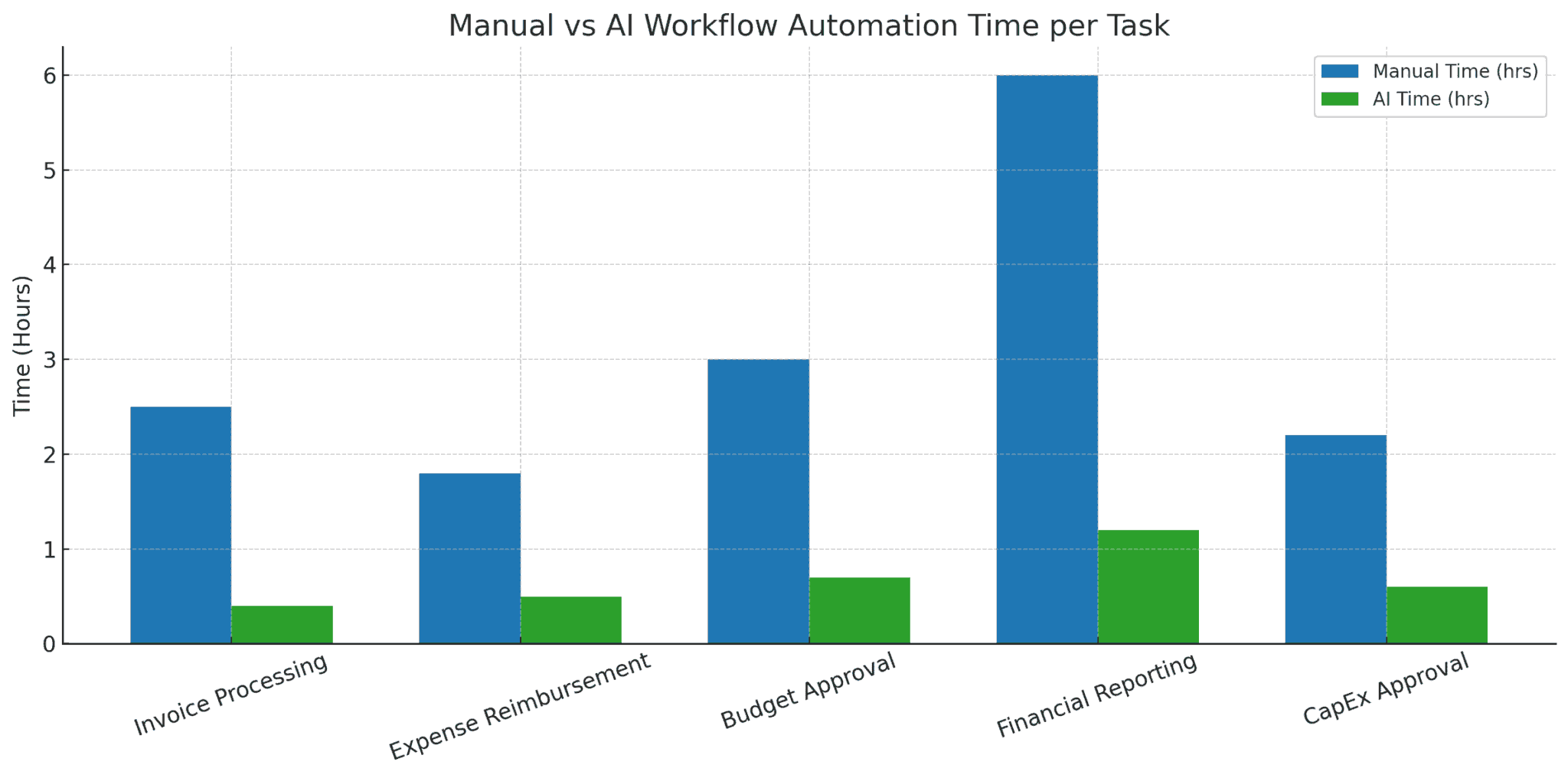

Manual vs AI Workflow Automation in Finance: Time, Cost, and Accuracy Comparison

Security, Compliance & Control in Financial Workflows

In finance, trust is everything, and trust starts with control. When your workflows handle invoices, budgets, and sensitive financial data, security can’t be a checkbox. It has to be built into the DNA. That’s where Cflow’s enterprise-grade governance comes in.

Data Encryption That Doesn’t Blink

Cflow uses end-to-end encryption to protect files and financial documents in transit and at rest. From vendor contracts to bank statements, every upload is secured automatically.

Audit-Ready from Day One

With Workflow Monitor and Request History, every action—every click—is logged. Who approved what, when, and why? You’ll never have to scramble for an audit trail again. It’s all there, time-stamped and traceable.

Authentication You Can Trust

Whether you’re on Google Workspace or Microsoft Office 365, Cflow supports Single Sign-On (SSO) so users log in through secure, familiar credentials. For tighter access control, integrate with Active Directory and manage permissions centrally.

Custom Roles and Permissions

Not everyone needs to see everything. With role-based access and custom permissions, you can ensure that users only view or act on the workflows relevant to them, critical for internal compliance and information hygiene.

Seamless Integration with SAP

For large enterprises, Cflow’s SAP integration ensures your workflow automation platform plays nice with your ERP system—no silos, no sync issues.

Bottom line: Cflow doesn’t just automate your finance processes. It wraps them in a secure, compliant, and controllable layer—so you can innovate without ever compromising trust.

Next, let’s talk about who’s really in charge: your finance team. With Cflow, they no longer need IT handholding. Let’s look at how no-code power puts them in the driver’s seat.

Did You Know?

Finance teams in the UK spend up to 60% of their time on manual tasks like data entry, chasing approvals, and reconciling spreadsheets.

Source: Sage UK – State of Automation in Finance

No-Code Power: Empowering Finance Without IT Dependency

Imagine a world where your finance team can build, modify, and launch complex workflows without waiting on IT. No tickets. No dev cycles. Just pure, empowered execution. That’s the promise of Cflow’s no-code automation—and it’s a game-changer for finance.

Visual Workflow Builder: Drag, Drop, Deploy

Cflow’s drag-and-drop designer lets you map out approval chains, add logic, and set rules visually. Whether it’s a CapEx workflow or a reimbursement form, your finance ops team can customise it end-to-end, on their own.

Form Builder Without Friction

Need a new form for vendor onboarding or FX payments? With Cflow’s no-code form builder, you can create and deploy one in minutes, complete with validations, conditional fields, and document upload options. Zero coding required. Total control retained.

Clone, Tweak, Reuse

Why build from scratch every time? Clone existing workflows to adapt for a new region, department, or policy. Update just what’s needed. Consistency meets speed.

Make Changes On the Go

Finance isn’t static. Budgets change. Policies shift. Teams grow. Cflow’s mobile app lets you manage, approve, and even tweak workflows from anywhere. Your processes evolve as your business does.

This is where Cflow stands out. It gives power back to the people who live and breathe finance, without forcing them to learn Python or chase developers. It’s agile. It’s intuitive. And most importantly, it puts your team on the fast track to transformation.

And if you’re wondering whether it works in the real world? Let’s take a look at a finance team that’s already leapt—and won.

End-to-end workflow automation

Build fully-customizable, no code process workflows in a jiffy.

Case Example: How NutriAsia Streamlined Purchase Approvals with AI Workflow Automation

Let’s get real—when a business is growing fast, outdated processes can become bottlenecks. That’s exactly what NutriAsia faced. As one of the leading food manufacturers in the Philippines, managing procurement across multiple plants wasn’t just complex—it was chaotic.

The Problem:

NutriAsia’s purchase approval process was spread across spreadsheets, emails, and manual trackers. Delays were frequent, visibility was poor, and accountability suffered. With hundreds of purchase requests coming from multiple departments, approvals got buried in inboxes, and tracking them? Nearly impossible.

The Switch:

NutriAsia implemented Cflow to automate their entire purchase request and approval cycle. Their new AI-enabled workflow included:

- Predefined templates tailored to procurement processes

- Multi-level conditional routing based on department, value, and urgency

- Email approvals without login for faster manager response

- Visual dashboards for end-to-end visibility

- Role-based access to ensure compliance and control

The Result:

- Approval turnaround time reduced by 70%

- Full transparency across 13 departments

- Compliance improved with auto-escalation triggers

- Procurement team efficiency increased significantly

- Stakeholders across the organisation praised the improved visibility

Cflow didn’t just digitise NutriAsia’s approval process—it made it intelligent, transparent, and scalable. Finance, procurement, and plant teams now work in sync, with less follow-up and more flow.

And the best part? They launched without hiring a single developer. No code. No complexity. Just a clean, effective transformation.

So—what’s your team still wrestling with? Let’s build your flow today.

Did You Know?

Firms that adopted AI-driven finance automation in the UK saw a 30% decrease in audit preparation time and a 40% improvement in reporting accuracy.

Source: Pwc UK – Finance Digital Transformation Survey

Getting Started with Cflow for Finance and Accounting

Transitioning to AI workflow automation may sound like a massive leap, but with Cflow, it’s more like stepping onto an escalator. Smooth, fast, and surprisingly simple. Whether you’re managing approvals, audits, or reimbursements, Cflow gets you up and running with zero friction.

Prebuilt Templates to Hit the Ground Running

Cflow comes packed with ready-to-use workflow templates—including ones tailored for invoice approvals, budget tracking, and reimbursement processes. Just plug and play, then tweak to fit your internal policies.

Step-by-Step Onboarding

You don’t need a tech background or a week-long bootcamp. Cflow walks you through setup with an intuitive UI, in-app guidance, and a dedicated support team ready to assist. You’ll have your first workflow live before your next coffee break.

No-Code Customisation, On Your Terms

Need to add an approval layer? Change the form fields? Trigger alerts for delayed tasks? All of it—doable without writing a single line of code. Just drag, drop, and configure.

Invite Stakeholders with Ease

Approvals can happen via email or without a login. You can even let external partners submit requests securely using public forms. No more access issues or IT delays.

From CFOs to finance analysts, everyone can contribute to building and optimising processes. With Cflow, finance automation becomes a team sport—fast, smart, and scalable.

Still stuck in spreadsheet purgatory? Time to move forward—with flow.

Conclusion: Finance, Reimagined with AI Workflow Automation

Finance teams are no longer just the gatekeepers of budgets—they’re the engines of strategic growth. But that shift only happens when the old ways—manual approvals, spreadsheet chaos, reactive reporting—are left behind. AI workflow automation isn’t just a tech upgrade. It’s a mindset shift.

With Cflow, you don’t need to code. You don’t need to wait for IT. You just need a vision—to eliminate inefficiencies, boost accuracy, and reclaim time for what really matters.

From invoice approvals to audit trails, Cflow puts intelligence, speed, and control at your fingertips. It’s secure. It’s scalable. And it’s ready to power the next generation of finance.

Start your finance automation journey with Cflow – no coding, no delays, just results.

Today’s finance departments need more than spreadsheets—they need intelligence that adapts. AI workflow automation offers that agility. For UK companies navigating post-Brexit uncertainty, tightening regulations, and ESG reporting pressures, automating financial workflows isn’t a luxury, it’s survival.

With Cflow’s no-code platform, your finance team can do more with less, all while staying compliant, efficient, and prepared for scale.

Begin your finance transformation with Cflow – quick to deploy, simple to use, and built for the modern financial landscape.

FAQs

- How does Cflow help automate invoice approvals?

Cflow uses OCR to capture invoice data, applies approval rules based on value or department, and routes them for instant email approvals—minimising delays and errors. - Can I use AI without coding knowledge in finance automation?

Absolutely. Cflow’s no-code interface lets you build intelligent workflows using drag-and-drop tools. No technical skills required—just your process knowledge. - What kind of finance reports can I generate with Cflow?

You can generate real-time dashboards, tabular reports, and even custom reports. Export them in Excel, PDF, or CSV formats, or integrate with Power BI. - Is Cflow secure for storing financial documents?

Yes. Cflow offers end-to-end encryption, role-based access, audit trails, and compliance-ready controls, including SSO, Active Directory, and SAP integration for enterprise-grade security.

Thanks for reading till the end. Here are 3 ways we can help you automate your business: Create workflows with multiple steps, parallel reviewals. auto approvals, public forms,

etc. to save time and cost. Get a 30-min. free consultation with our Workflow expert to optimize

your daily tasks. Explore our workflow automation blogs, ebooks, and other resources to master

workflow automation.What should you do next?

Do better workflow automation with Cflow

Talk to a workflow expert

Get smarter with our workflow resources

Get Your Workflows Automated for Free!