Cash Flow Statement Approvals

An automated cash flow statement approval process enhances the accuracy and consistency of financial reporting.

Why automate?

The accuracy and the level of detailing in financial reporting is closely associated with the manner in which financial data is collated, verified, and approved. Various financial reports like cash flow statements, balance sheets, or liquidity statements, involve lengthy preparatory and approval steps. These statements provide the management and financial teams with inputs required for making financial decisions.

However, going about the reporting process that traditional way is prone to delays and inconsistencies. Given the importance of financial statement review and approval, it would not be a wise decision to stick to manual methods. Automating the cash flow statement approval process is a great way to overcome the drawbacks of manual processes and streamlining the workflow. A workflow solution like Cflow can turn the tables around for the cash flow statement approval process by eliminating associated redundancies and inconsistencies. Choose workflow automation for accurate and sound financial planning.

How Cflow Can Help Automate the Process

Centralized Statement Preparation and Submission

Cflow enables the centralized preparation and submission of cash flow statements, ensuring all relevant data is accurately captured. This standardization simplifies the approval process and enhances data consistency.

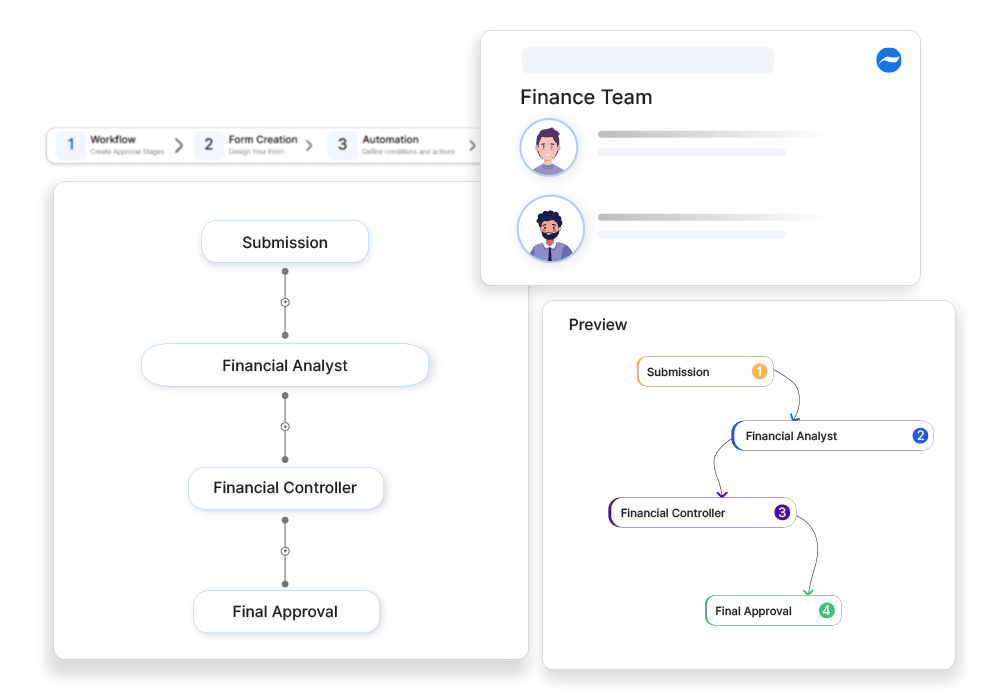

Streamlined Approval Workflows

Cash flow statements are routed through a predefined approval workflow, involving finance teams and senior management. This ensures thorough review and timely approval, supporting reliable financial reporting.

Comprehensive Reporting and Analysis

Cflow provides detailed reports on cash flow statement approvals, including cash flow analysis and trends. This transparency supports better liquidity management and financial decision-making, providing insights into the organization’s cash position.

Automated Data Verification

The system can automatically verify the accuracy of cash flow data, checking for consistency with other financial statements and accounting records. This helps ensure the integrity of financial reporting.