Transforming Finance: How to Streamline Your Paperless Accounts Payable Process

Key takeaways

- A paperless accounts payable process reduces invoice processing costs by up to 80% and cuts approval cycles in half.

- Companies using automated AP solutions report up to 30% faster vendor payments and improved cash flow visibility.

- Transitioning to a digital AP workflow improves compliance, reduces manual errors, and increases audit readiness.

- Cloud-based AP systems offer secure, centralized access to all financial documents and support remote approvals.

- Tools like Cflow provide no-code automation to digitize invoice receipt, approvals, and payments across finance operations.

Table of Contents

What is the Paperless Accounts Payable Process?

A paperless accounts payable process refers to the digital management of vendor invoices, approvals, and payments without relying on physical documents. The need for speed, accuracy, and scalability in finance departments has made the paperless approach a priority for organizations of all sizes.

Digital accounts payable supports remote work, enhances financial controls, and ensures vendors are paid on time, all while reducing operational costs. In this blog, we’ll cover automation of the accounts payable process, benefits of going paperless, and best practices for transitioning to digital AP systems. Whether you’re a CFO seeking efficiency or an AP manager looking to reduce paperwork, this guide will help you understand and implement a streamlined, paperless AP process.

Need for Paperless Accounts Payable Process

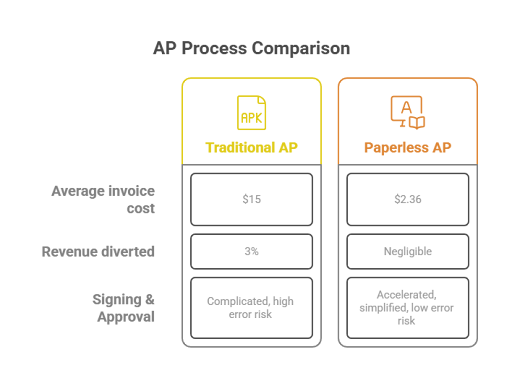

In a traditional AP system, invoices are manually received, routed for approval, matched against purchase orders, and finally paid, often involving printing, scanning, and filing paper records. The average cost of processing an invoice through manual paper-based processes is $15. This not only slows down processing but also introduces human errors, lost documents, and compliance risks.

In contrast, a paperless AP process leverages technology to digitize every step. Invoices are received electronically via email or vendor portals, automatically captured using OCR (Optical Character Recognition), routed for approval based on predefined workflows, and stored in cloud-based systems for easy access and auditability. Payments are processed electronically, with tracking and reporting features providing full visibility into the payment lifecycle.

How to Automate the Accounts Payable Process

Automating the accounts payable process is essential for companies aiming to improve accuracy, reduce costs, and accelerate payment cycles. A manual AP process involves time-consuming tasks such as entering invoice data, verifying purchase orders, chasing down approvals, and cutting physical checks. Automation replaces these steps with digital workflows that are faster, more reliable, and easier to scale.

The first step in automation is to digitize invoice intake. Vendors can email invoices or upload them through a self-service portal. These invoices are captured automatically by the AP system using OCR technology, which extracts key data like vendor name, invoice number, date, and total amount. This eliminates manual data entry and significantly reduces errors.

Next, the invoice moves through an automated approval workflow. Based on predefined rules, the system routes invoices to the appropriate approvers depending on department, invoice amount, or project code. Notifications and escalations ensure that approvals don’t get delayed. Approvers can review and authorize payments from anywhere—via desktop or mobile.

Once approved, the invoice is matched with purchase orders and receipts. If everything checks out, the system schedules the payment and updates the general ledger. Payments can be made via ACH, wire transfer, or virtual cards—all tracked and recorded in real time.

Automated AP systems also offer real-time dashboards and reporting features. These provide finance teams with visibility into outstanding liabilities, cash flow trends, and vendor performance. Integration with ERPs ensures seamless syncing of data, reducing reconciliation work at month-end.

Overall, automation transforms AP from a back-office function into a strategic asset. It ensures timely payments, enhances vendor relationships, reduces the cost per invoice, and frees up staff to focus on higher-value financial tasks.

Benefits of a Paperless Accounts Payable System

Switching to a paperless accounts payable system delivers significant advantages across multiple dimensions—cost savings, process efficiency, compliance, and scalability. Companies that digitize their AP processes not only eliminate physical clutter but also gain more control over their cash flow and vendor management.

One of the most immediate benefits is cost reduction. Paper-based AP systems incur expenses such as printing, postage, filing supplies, and storage space. According to industry reports, businesses spend an average of $12–$25 to process a single paper invoice. A paperless system can reduce this to as low as $3 per invoice. Over time, these savings add up, especially for high-volume AP departments.

Beyond cost, efficiency is dramatically improved. In manual environments, invoice approvals can take days or even weeks, especially when documents must be physically routed between departments. With digital workflows, invoices are routed instantly, approvers are notified automatically, and escalations are triggered when deadlines are missed. This shortens payment cycles, helps avoid late fees, and can even qualify the business for early payment discounts.

Compliance and audit readiness are also enhanced. Paperless systems maintain digital trails of every action—when an invoice was received, who approved it, when it was paid, and how it was classified. This simplifies both internal audits and external regulatory reporting, reducing risk and ensuring transparency.

Scalability is another major advantage. As businesses grow, manual AP systems struggle to keep up with increased volume. A digital AP solution can handle hundreds or even thousands of invoices per month without needing to hire more staff. Features like vendor self-service portals, duplicate invoice detection, and automatic 2- or 3-way matching allow teams to work smarter, not harder.

Finally, a paperless AP system contributes to workplace modernization. It supports remote work, integrates with existing finance systems, and aligns with ESG (Environmental, Social, and Governance) goals by reducing paper waste. As more businesses pursue digital transformation, AP automation becomes a vital part of their strategic toolkit.

Steps to Create a Digital AP Workflow

Creating a digital accounts payable workflow is a structured process that requires thoughtful planning, the right technology, and team alignment. It’s not just about scanning documents; it’s about reengineering the way invoices are received, reviewed, approved, and paid. Here’s a step-by-step guide to designing a robust digital AP workflow:

- Analyze your current AP process

Start by documenting your existing accounts payable process. Identify where paper is being used, which tasks are manual, how invoices are routed, and where delays or errors commonly occur. This assessment will help pinpoint areas for automation and prioritize high-impact improvements. - Choose a paperless AP solution

Select a software platform that supports invoice capture, approval routing, PO matching, and payment automation. Look for features like OCR, cloud access, mobile approvals, audit trails, and ERP integration. Tools like Cflow provide a no-code platform where AP teams can design custom workflows tailored to their unique processes. - Digitize invoice intake

Set up channels for receiving invoices electronically. This can include a dedicated email inbox, vendor portal, or EDI (Electronic Data Interchange). Use OCR tools to convert scanned or PDF invoices into structured data for easy processing. - Define workflow rules and roles

Create digital workflows that reflect your business policies. For example, invoices under $1,000 may require one level of approval, while those above may need multi-level authorization. Assign roles for each stakeholder—AP staff, department heads, and finance controllers—based on approval limits and responsibilities. - Set up notifications and escalations

Configure the system to send real-time alerts to approvers. If an invoice remains unapproved after a certain period, escalate it to the next level. This ensures timely processing and reduces the risk of missed payments. - Integrate with finance systems

Connect your AP platform with your accounting or ERP software to ensure data synchronization. This allows for automatic updates of vendor records, payment statuses, and financial reports. - Monitor, measure, and optimize

Use built-in analytics to track KPIs such as average invoice processing time, approval delays, and payment accuracy. Regularly review performance and make adjustments to workflows as your business evolves.

By following these steps, businesses can replace slow, paper-heavy AP processes with efficient, transparent, and scalable digital workflows that support growth and financial control.

Best Software for Paperless Accounts Payable

Choosing the right software is crucial to successfully implementing a paperless accounts payable system. The best solutions offer a balance of automation, usability, integration, and security, ensuring your AP team can process invoices quickly and accurately with minimal manual intervention.

One of the top platforms for AP automation is Cflow, a no-code workflow automation solution that allows finance teams to build customized accounts payable processes without IT involvement. Cflow’s intuitive visual builder helps users design invoice approval workflows, set role-based access, define routing rules, and integrate with existing systems such as QuickBooks, Xero, or Oracle NetSuite.

Key features of Cflow and other leading platforms include:

- OCR-based invoice capture: Extracts and populates invoice data automatically from PDFs or scanned documents.

- Customizable approval workflows: Set rules for routing invoices based on value, department, or vendor.

- Cloud document storage: Securely stores all AP documents for fast retrieval, auditability, and compliance.

- Real-time notifications: Alerts approvers instantly when action is required, reducing approval delays.

- Mobile accessibility: Allows finance managers to approve invoices or review transactions on the go.

- Vendor self-service portals: Vendors can submit invoices and track payment status, reducing email clutter and improving transparency.

Other popular software options include Tipalti, AvidXchange, Stampli, and Beanworks. These tools cater to different business sizes and industries, with some offering specialized features like multi-currency support, tax compliance automation, and early payment discount management.

When selecting software, consider your current AP volume, integration requirements, and team size. Look for platforms that provide scalability, user-friendly interfaces, and responsive support. It’s also advisable to choose a vendor with clear data security policies and compliance certifications such as SOC 2 or ISO 27001.

Ultimately, the right software empowers your team to move away from spreadsheets, reduce bottlenecks, and focus on strategic financial oversight instead of clerical tasks.

Implementing AP Automation in Small Businesses

For small businesses, the shift to a paperless accounts payable process can feel overwhelming, but it doesn’t have to be. In fact, small teams often see the fastest return on investment from AP automation because they deal with limited staffing, tighter cash flow, and high sensitivity to operational inefficiencies.

The first step is to understand your AP pain points. Are invoices getting paid late? Is your team spending too much time entering data or chasing approvals? Identify the biggest inefficiencies and use them to define your automation goals.

Small businesses can benefit significantly from cloud-based platforms that offer affordable pricing, quick implementation, and user-friendly interfaces. Tools like Cflow are especially ideal, as they allow finance teams to build automated AP workflows without the need for developers or technical expertise.

Key advantages for small businesses include:

- Time savings: Automation reduces manual data entry, filing, and follow-ups—freeing staff for more important tasks.

- Improved accuracy: Digital forms and validation rules prevent duplicate invoices, missed approvals, and entry errors.

- Cash flow visibility: Dashboards give business owners real-time insight into pending liabilities and upcoming payments.

- Remote functionality: Team members can approve invoices, manage documents, and issue payments from any location.

Small businesses should start small—digitizing one or two core workflows like invoice approvals or vendor payments—before scaling to more complex operations. Training is also key. Ensure that team members are confident using the new system by providing walkthroughs, help docs, and ongoing support.

Finally, automation is an investment that pays for itself. By reducing payment errors, eliminating late fees, and capturing early payment discounts, small businesses can offset the cost of AP software within months.

Regional Adoption of Paperless Accounts Payable Automation

North America

- Dominated the AP automation market with 33–35% of global revenue share in 2023

- A survey revealed 74% of businesses plan to automate their AP function this year, and 88.6% of managers believe automation enables their teams to concentrate on strategic work

- As a result, 52% of AP professionals now spend less than 10 hours per week on invoice processing, improved from 62% last year.

Europe

- Rapid growth in AP automation is driven by strong compliance demands and digital mandates

- Over 60% of UK teams currently spend more than 5 days per month processing invoices manually, with many transitioning to streamlined digital systems

Asia‑Pacific

- APAC is the fastest-growing regional segment in AP automation, with the highest CAGR expected through 2030

- Countries like China, India, Japan, South Korea, and Australia are investing heavily in digital finance modernization and cloud-based AP solutions

Latin America

- Driven largely by mandatory e‑invoicing rules in Brazil, Mexico, and Chile, where over 58% of invoices were electronic by 2014

- Companies like Coca‑Cola Andina reduced inbound invoice costs by up to 70% through e‑invoicing

Middle East & Africa

- Adoption is emerging, especially in the UAE, Saudi Arabia, and South Africa, supported by broader digital transformation initiatives.

Security and Compliance in Digital AP Systems

Security and compliance are top priorities when transitioning to a digital accounts payable system. Financial data, especially vendor information, bank details, and invoices, must be protected against breaches, fraud, and unauthorized access. Paperless systems, when properly implemented, provide far stronger safeguards than traditional paper-based processes.

Modern AP automation platforms are built with enterprise-grade security standards, including encryption at rest and in transit, role-based access control, and regular vulnerability assessments. Sensitive data is stored in secure cloud environments with redundancy, ensuring business continuity and disaster recovery.

Compliance advantages include:

- Audit trails: Every document interaction—uploads, approvals, edits, and payments—is logged automatically. This transparency makes internal and external audits faster and more reliable.

- Retention policies: Documents can be stored according to tax or regulatory requirements and automatically purged after expiration.

- Role-based access: Only authorized users can access, view, or modify financial data. This reduces internal fraud risks and maintains the separation of duties.

- Compliance certifications: Many leading AP platforms are certified for SOC 2, ISO 27001, GDPR, and HIPAA standards, ensuring adherence to global regulations.

For AP managers and CFOs, digital systems reduce exposure to financial risk and regulatory penalties. By removing paper and adding automation, you not only secure your data but also create a framework for long-term financial integrity.

End-to-end workflow automation

Build fully-customizable, no code process workflows in a jiffy.

Transitioning from Paper-Based AP to Digital Processes

Transitioning from a paper-based accounts payable system to a fully digital one is a strategic move that requires planning, communication, and gradual adoption. It’s important to approach the change as a business transformation, not just a technology upgrade.

Begin by involving key stakeholders—finance, procurement, IT, and executive leadership. Explain the inefficiencies of the current system and build consensus around the benefits of going digital. Establish clear goals such as reducing invoice cycle times, cutting processing costs, and improving cash flow visibility.

Steps to transition effectively include:

- Start with a pilot: Choose one or two AP workflows—such as invoice approvals or vendor onboarding—to digitize first. This helps build internal confidence and uncover early lessons.

- Clean up vendor data: Consolidate and validate your vendor master list. Ensure email addresses, payment methods, and tax information are up to date.

- Digitize historical documents: Scan and organize existing invoices and contracts. Store them in a cloud-based document management system for future reference.

- Train your team: Offer hands-on training and provide resources like FAQs and video tutorials. Highlight how digital workflows make their jobs easier and more efficient.

- Monitor and improve: Use analytics to measure success. Track KPIs like invoice processing time, approval cycle duration, and cost per invoice to guide continuous improvement.

A phased approach reduces disruption and makes the transition more manageable. With the right tools and support, businesses can go from stacks of paper to streamlined, paperless processes, setting the stage for a more agile and scalable finance function.

Final Thoughts

The paperless accounts payable process is no longer a luxury—it’s a necessity for modern finance teams striving for speed, accuracy, and scalability. By eliminating manual paperwork, organizations can reduce invoice processing costs, accelerate approvals, improve compliance, and create better visibility into financial operations. A digital AP workflow also supports remote collaboration, enhances vendor relationships, and strengthens internal controls.

A Grandview Research report reveals that the Global AP automation market was estimated at around USD 3.08 billion in 2023, and is expected to grow at a CAGR of 12.8% to reach USD 7.01 billion by 2030.

With powerful no-code tools like Cflow, businesses of all sizes can easily design, automate, and optimize their AP processes without relying on IT. Whether you’re managing a few invoices a week or thousands a month, transitioning to a paperless AP model empowers your team to focus on strategic goals instead of administrative burdens.

Now is the time to rethink your accounts payable operations. Digitize your AP process, reduce errors, and gain complete control over your payments—one workflow at a time.

Get started with Cflow today and experience how effortless accounts payable can be when it’s paperless.

FAQs

What is a paperless accounts payable process?

A paperless accounts payable process is a fully digital system for handling invoices, approvals, and vendor payments without physical paperwork. It uses automation, cloud storage, and electronic approvals to reduce errors, improve speed, and support compliance.

How much money can I save by going paperless in AP?

Businesses can reduce invoice processing costs by up to 80%. Traditional paper-based processing can cost $12–$25 per invoice, while digital systems reduce it to $2–$5. This translates to significant annual savings, especially for companies with high invoice volume.

Is AP automation secure and compliant?

Yes. Reputable AP software platforms use encryption, access controls, and audit trails to protect financial data. Most are compliant with standards like SOC 2, ISO 27001, GDPR, and HIPAA, ensuring regulatory compliance and secure handling of sensitive vendor information.

Can small businesses benefit from paperless AP systems?

Absolutely. Small businesses often see the fastest ROI from AP automation due to time savings, reduced errors, and improved vendor payment timelines. Affordable, scalable platforms make it easy for small teams to implement digital workflows without needing IT support.

How long does it take to transition to a paperless AP process?

The timeline depends on the complexity of your current process, but many businesses can launch a pilot within a few weeks. A phased approach—starting with invoice approvals or vendor onboarding—makes the transition smoother and easier to manage.

What should you do next?

Thanks for reading till the end. Here are 3 ways we can help you automate your business:

Do better workflow automation with Cflow

Create workflows with multiple steps, parallel reviewals. auto approvals, public forms, etc. to save time and cost.

Talk to a workflow expert

Get a 30-min. free consultation with our Workflow expert to optimize your daily tasks.

Get smarter with our workflow resources

Explore our workflow automation blogs, ebooks, and other resources to master workflow automation.