Finance Approval Workflows That Scale with Your Organisation

Key takeaways

- Manual finance approval workflows limit organisational agility and expose companies to bottlenecks, errors, and compliance risks.

- Scalable finance workflows allow businesses to enforce policies while adapting to organisational growth and complexity.

- Workflow automation helps standardise multi-level approvals and ensures faster processing with full audit trails.

- Tools like Cflow empower finance teams to create flexible, scalable approval systems with no-code design and seamless integrations.

Financial decisions are the backbone of organisational success. Whether it’s approving vendor invoices, processing capital expenditure requests, or managing employee reimbursements, every financial activity requires timely approvals. As businesses grow in size and complexity, traditional approval methods—such as emails, spreadsheets, and verbal confirmations—become inadequate.

With expansion comes the need to accommodate more stakeholders, additional approval layers, and stricter compliance requirements. Without a scalable finance approval workflow in place, companies face bottlenecks, inconsistencies, and delayed decision-making that can directly impact cash flow and vendor relationships.

According to Accenture, up to 80% of transactional activities in finance can be automated, including approvals for invoices, expenses, and capital requests.

This blog explores how finance approval workflows can be optimised to scale with your organisation, the key benefits of automation, and tools to build a future-proof financial operations framework.

What is a Finance Approval Workflow?

A finance approval workflow is a predefined process that governs how financial requests—such as budgets, invoices, and reimbursements—are submitted, reviewed, and approved. These workflows standardise approvals, route documents through appropriate channels, and log every action for traceability.

Key components include:

- Submission forms: For employees to initiate finance-related requests.

- Approval routing logic: To direct requests to the appropriate stakeholders.

- Audit logs and status tracking: To ensure compliance and accountability.

Scalable finance approval workflows are built to accommodate business growth, support multiple departments, and ensure real-time visibility across approval stages.

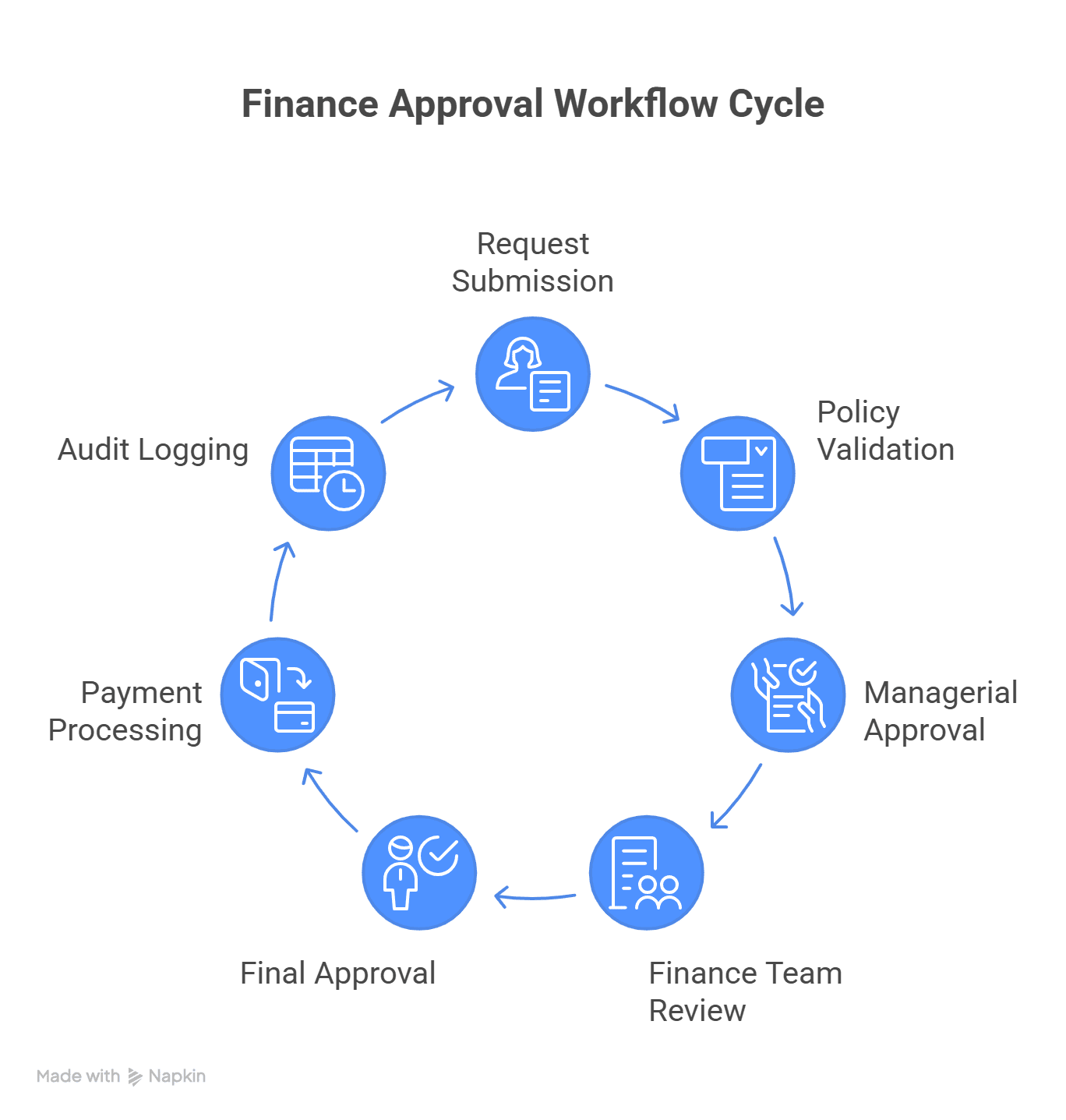

Stages of a Finance Approval Workflow

A finance approval workflow is a structured process that governs how financial requests—such as expenses, purchases, and capital allocations—are reviewed, validated, and approved within an organisation. Below are the key stages that ensure compliance, accountability, and timely execution.

1. Request Submission

The process begins when an employee submits a finance-related request—such as an expense claim, purchase order, or capital expenditure proposal—through a digital form with supporting documents.

2. Policy Validation

Before routing, the system automatically checks the request against pre-configured company policies (e.g., budget limits, categories, duplicate entries) to ensure compliance.

3. Managerial Approval

The request is routed to the immediate supervisor or department head for review. They assess the necessity, budget availability, and justification for the expense.

4. Finance Team Review

After managerial approval, the finance department verifies supporting documents, account codes, and policy adherence. Any discrepancies are flagged for correction.

5. Final Approval (if required)

For high-value or strategic requests, an additional layer of approval may be required—typically from senior management, finance controllers, or the CFO.

6. Payment Processing or Execution

Once fully approved, the request moves to payment or execution. This could mean releasing funds, generating a PO, or triggering reimbursement through integrated accounting/ERP systems.

7. Audit Logging and Reporting

The workflow logs all approvals, rejections, and timestamps for compliance and reporting. This ensures traceability for audits and financial governance.

Common Challenges in Finance Workflows

As organisations grow, finance workflows that once seemed manageable can become sources of inefficiency and risk. Below are the most pressing issues:

Manual Dependencies

Approval processes often rely heavily on emails, spreadsheets, or physical signatures. This leads to unnecessary back-and-forth, delayed responses, and inconsistent follow-ups—especially when approvers are unavailable or overwhelmed.

Approval Overload

Executives and senior managers frequently receive low-priority requests that could be delegated. This overburdens leadership, clogs up high-level workflows, and delays decisions that require urgent attention.

Lack of Visibility

Without a centralised dashboard or tracking mechanism, it’s hard to know where a request is stuck or who needs to take action. This lack of transparency frustrates employees and finance teams alike, often leading to duplicated efforts or missed deadlines.

Policy Violations

In manual systems, enforcing company policies is difficult. Approvals may occur without the necessary documentation or oversight, increasing the risk of non-compliance, budget overruns, or even fraud.

No Integration Across Systems

When your expense management, accounting, and HR systems don’t talk to each other, data has to be entered multiple times. This results in version mismatches, errors, and time-consuming reconciliations—all of which slow down the entire finance function.

Benefits of Workflow Automation in Finance Approvals

Manual approval processes are not only time-consuming—they’re prone to errors, inconsistencies, and oversight gaps. Workflow automation addresses these problems by creating standardised, repeatable processes.

1. Faster Approvals

Automation accelerates routing and reduces the time approvers spend reviewing requests, especially when policies are pre-validated.

2. Shorter Cycle Times

With automated reminders, routing rules, and escalations, approval workflows move swiftly, avoiding the common delays of manual follow-ups.

3. Accurate Financial Data

Automation reduces human error by pulling data directly from source systems and applying validation logic before approvals happen.

4. Enforced Policy Compliance

Rules are enforced at each stage, ensuring that no request bypasses the system or gets approved without required checks.

5. End-to-End Traceability

Every action is logged—making it easy to trace back approvals, address disputes, and demonstrate compliance during audits.

Example: In accounts payable, automating invoice approvals ensures vendors are paid on time, reduces late fees, and minimises friction with suppliers.

Key Statistics on Finance Approval Workflows

- A substantial 62% of businesses have identified three or more major inefficiencies or bottlenecks in their business processes that could potentially be solved with effective workflow automation.

- Automation has improved jobs for 90% of knowledge workers and productivity for 66% of them.

- Accenture estimates that up to 80% of the finance department’s transactional workflow could be automated.

- Companies with automated reporting processes report 91% fewer errors in financial statements.

- Payment automation allows businesses to free up over 500 hours annually in their finance departments.

End-to-end workflow automation

Build fully-customizable, no code process workflows in a jiffy.

How Workflow Automation Works in Finance Approvals

Workflow automation in finance approvals replaces manual, repetitive tasks with rule-based digital processes that route, validate, and track approval requests automatically. Here’s how it functions step-by-step within a financial context:

1. Request Initiation

An employee submits a financial request—like a purchase order, travel expense, or budget allocation—through a digital form. This form is customised to capture all required fields such as cost centre, amount, justification, and attachments.

2. Policy Validation

Before routing, the system automatically checks the request against pre-set company policies. For example, if the amount exceeds a specific limit or lacks documentation, it’s flagged or returned to the requester.

3. Role-Based Routing

Using conditional logic, the request is sent to the appropriate approver(s) based on factors like amount, department, or request type. Multi-tier approval flows can be triggered without manual intervention.

4. Notifications and Escalations

Automated reminders are sent to approvers to avoid delays. If no action is taken within a specified time, the request is escalated to a higher authority or alternate approver.

5. Approval or Rejection

Approvers review the request, add comments, and either approve or reject it within the platform. Each action is time-stamped and stored for audit purposes.

6. System Integration

Once approved, the workflow triggers further actions—such as initiating payment, updating the ERP, or notifying the finance team. This seamless integration ensures financial records stay accurate and up to date.

7. Audit Trail and Reporting

Every step in the approval process is logged in a central dashboard. Finance leaders can track trends, identify bottlenecks, and download reports for audits or compliance checks.

Why Scalability in Finance Approval Workflows Matters

As organisations grow—whether by expanding operations, adding new departments, or entering new regions—their financial approval processes become increasingly complex. A static or overly rigid approval structure can significantly hinder operational agility. It may slow down time-sensitive decisions, create over-reliance on a limited group of approvers, and increase the likelihood of errors or fraud due to inconsistent oversight.

Scalable finance approval workflows offer a more flexible and future-proof solution. They enable finance leaders to set up dynamic rules that adapt based on department, transaction size, urgency, or geographic location—all without the need for constant IT intervention. This adaptability ensures that the approval process remains efficient, compliant, and responsive, supporting business growth rather than stalling it.

How to Scale Finance Approval Workflows for Growth and Compliance

As businesses scale, their financial operations must evolve to support increased transaction volumes, more stakeholders, and stricter compliance needs. A robust finance approval workflow must not only accommodate growth but also enable it. Here’s how:

1. Define Clear Roles and Hierarchies

Assigning roles dynamically ensures that each approval request is routed to the right person based on transaction type, value, or department. For example, a low-value marketing expense may go to a team lead, while a CapEx request routes directly to finance.

2. Automate Multi-Tier Approvals

Automation allows companies to set up tiered workflows where requests are escalated automatically based on predefined thresholds. This eliminates the need for manual handovers and speeds up decision-making across departments.

3. Enforce Policy-Based Controls

Policy rules can be embedded directly into the workflow—blocking non-compliant entries from moving forward. This ensures consistent enforcement of approval limits, budget caps, and documentation requirements.

4. Enable Real-Time Collaboration

Modern approval systems allow stakeholders to comment, tag team members, and resolve queries within the platform. This prevents long email threads and enables quick, contextual decision-making.

5. Ensure Auditability

Detailed logs for every step—who approved what and when—are automatically generated. This not only simplifies audits but also increases transparency and accountability across financial processes.

These best practices ensure that finance workflows become enablers of scale, rather than barriers to growth.

Streamlining Finance Approvals with Cflow

Automating finance approval workflows can significantly reduce delays, enforce policy compliance, and boost productivity.

Here are two real-world examples of how organisations achieved faster, more efficient approvals using Cflow.

1. NutriAsia (Del Monte) – Automating CapEx Approvals

NutriAsia’s finance team faced persistent delays in handling CapEx approvals due to manual workflows involving spreadsheets and email threads. These inefficiencies impacted project timelines and made it difficult to track approvals across departments. After implementing Cflow, they automated the entire CapEx workflow, enabling dynamic routing, centralised documentation, and real-time tracking. This led to faster approval cycles, reduced delays, and a seamless transition to digital financial operations.

2. Godrej Capital – Enhancing Purchase and Invoice Workflow

Godrej Capital relied on ad hoc email-based methods to manage purchase orders and invoice approvals, leading to poor visibility and frequent process bottlenecks. By adopting Cflow, the company transformed its approval workflows with automation rules, integration capabilities, and centralised tracking. Finance teams could now issue POs and process invoices faster, improving vendor relationships and ensuring better financial control across the organisation.

Best Practices to Implement Scalable Finance Workflows

To build finance workflows that scale with your business, consider these actionable practices:

1. Design Modular Workflows

Create separate workflows for each financial process—like invoices, reimbursements, or CapEx—so changes can be made independently without disrupting other processes.

2. Use Role-Based Access Controls

Ensure that only authorised personnel can approve specific types of requests. This limits exposure to financial fraud and enhances accountability.

3. Adopt a No-Code Platform

No-code tools allow finance teams to design and modify workflows without IT help, ensuring speed and control remain in their hands.

4. Integrate with Core Systems

Link workflows with your ERP, HRMS, payroll, and document management tools. This eliminates duplication and ensures end-to-end financial visibility.

5. Monitor Workflow KPIs

Track performance indicators like approval cycle time, SLA breaches, and policy violations. Use this data to continuously refine and improve workflows.

How Cflow Helps in Streamlining Finance Approvals

Cflow is a powerful no-code workflow automation platform designed to bring clarity, control, and speed to finance approval processes. It eliminates manual interventions and enables finance teams to configure logic-driven workflows without IT support.

- Visual Workflow Builder

Cflow allows finance teams to design multi-level approval paths using an intuitive drag-and-drop interface—ideal for routing based on role, amount, or department. - Dynamic Role-Based Routing

Approvals can be automatically routed based on predefined rules like transaction size, cost center, or project category, reducing approval delays. - Policy Enforcement Engine

Built-in validation ensures that only compliant requests move forward. Out-of-policy entries are flagged and stopped before reaching approvers. - ERP and Accounting System Integration

Seamless integration with financial systems like QuickBooks, SAP, and Oracle ensures data flows automatically across platforms, reducing manual entry and errors. - Real-Time Notifications and Escalations

Instant alerts and escalation triggers keep stakeholders informed and ensure that high-priority approvals never get stuck or delayed. - Audit Trails and Compliance Logs

Every action is logged, ensuring end-to-end traceability. This improves transparency, simplifies audits, and supports regulatory compliance.

Conclusion

Scalable finance approval workflows are no longer optional—they’re essential for fast-growing organisations. By automating and standardising the approval process, businesses ensure financial control, speed, and compliance without adding an administrative burden. Platforms like Cflow make it easy to build and manage these workflows at scale.

Start automating your finance approvals today and position your business for sustainable growth.

FAQs

1. What is the process of payment approval?

The payment approval process involves validating a financial request, routing it to appropriate approvers based on rules, and executing the payment once approvals are complete.

2. What is an approval cycle?

An approval cycle is the sequence of steps a financial request goes through—submission, validation, routing, review, and final approval—before execution.

3. What is a workflow in ERP?

A workflow in ERP automates business processes like finance approvals by routing tasks, enforcing policies, and syncing data across departments within the ERP system.

4. What is a workflow flowchart?

A workflow flowchart visually maps out the approval process, showing steps, decision points, and the roles involved—making it easier to design and optimize financial workflows.

5. What is an example of a finance department workflow?

A common example is invoice approval: employees submit an invoice, it gets validated, routed to department heads and finance, and finally processed for payment in the ERP. Thanks for reading till the end. Here are 3 ways we can help you automate your business: Create workflows with multiple steps, parallel reviewals. auto approvals, public forms,

etc. to save time and cost. Get a 30-min. free consultation with our Workflow expert to optimize

your daily tasks. Explore our workflow automation blogs, ebooks, and other resources to master

workflow automation.

What should you do next?

Do better workflow automation with Cflow

Talk to a workflow expert

Get smarter with our workflow resources

Get Your Workflows Automated for Free!