Invoice Approval Workflows: Best Practices for Faster Payments

Key takeaways

- Automating invoice approval workflows can reduce processing time by up to 73% and eliminate bottlenecks across departments.

- Manual invoice processing increases the risk of late payments, duplicate entries, and vendor disputes.

- Finance teams that implement invoice approval workflow software gain better visibility and control over their cash flow.

- Adopting workflow automation allows companies to ensure faster invoice payments without compromising accuracy or compliance.

Invoices form the backbone of business transactions, yet many companies struggle with late payments due to poor workflow management. A broken invoice approval process leads to cash flow issues, vendor dissatisfaction, and compliance risks. With increasing pressure on finance teams to cut costs and speed up operations, automation offers a scalable and reliable solution.

Automated approval workflows cut invoice approval time by 2.5×, leading to 45% fewer late payments.

This blog explores the importance of invoice approval workflows, challenges in traditional processes, and best practices for setting up efficient, automated systems. We’ll also highlight how invoice approval workflow software can ensure faster invoice payments and provide complete visibility into every transaction.

What is an Invoice Approval Workflow?

An invoice approval workflow is a defined, repeatable process that governs how invoices are received, validated, and approved before payment is issued. It ensures that each invoice is properly reviewed for accuracy, verified against purchase orders or contracts, and authorised by the right stakeholders within the organisation.

Typically, the workflow begins with invoice capture—either manually or through digital systems—and proceeds through various checkpoints such as:

- Matching the invoice to a corresponding PO and delivery confirmation,

- Verifying line items, tax amounts, and vendor details,

- Routing to department heads or finance approvers for sign-off.

Each stage in this process is essential for maintaining financial control and ensuring policy compliance. In traditional setups, approvals are often handled through emails or printed documents, which slows down processing and increases the chances of errors or miscommunication.

How Invoice Payment Practices Have Evolved

Invoice processing has quietly undergone a major transformation over the past few decades. In the pre-digital era, paper invoices were mailed, stored in filing cabinets, and routed manually for approval—a slow and error-prone process often taking weeks. This method was manageable when transaction volumes were low and supplier networks were limited.

With the growth of global supply chains in the 1990s and early 2000s, businesses turned to spreadsheets, shared drives, and email-based approvals. While this reduced some paper clutter, it introduced new problems—fragmented tracking, missed approvals, and lack of version control.

Today, the shift is no longer just about digitisation—it’s about integration, visibility, and control. Modern invoice workflows are expected to align with dynamic business environments, where finance needs to act quickly, ensure accuracy, and maintain transparency across distributed teams.

This evolution—from reactive, manual handling to streamlined, policy-driven systems—has redefined invoice approvals from a back-office task into a strategic function within finance operations.

Challenges in Manual Invoice Processing

Manual invoice processing averages 20.8 days per invoice and costs $7.75 each. Automation can reduce this to just 3.8 days and $2.00 per invoice, while also improving accuracy.

Manual invoice approvals remain common across organisations. While they may seem manageable at smaller scales, they create major hurdles in high-volume environments:

- Delayed Payments: When invoices are stuck in email threads or lost in physical files, payment deadlines are missed.

- Fraud Risks: Lack of standardisation makes it easier for duplicate or fraudulent invoices to slip through.

- No Audit Trail: Manual methods rarely maintain proper records, leading to compliance issues during audits.

- Inconsistent Approvals: Different departments may follow varying procedures, making it difficult to track the invoice journey.

To overcome these issues, businesses are turning to invoice approval workflow automation to create transparency and eliminate process gaps.

Benefits of Invoice Approval Workflows

Financial institutions using workflow automation report a 30–50% reduction in operational costs for processes like invoice management and payment processing.

Modern invoice approval workflows go far beyond just speeding up payments—they transform how finance teams operate. By replacing fragmented, manual processes with automated systems, businesses gain end-to-end control over invoice validation, review, and authorisation.

Here are the key benefits of implementing invoice approval workflows:

1. Faster Payment Cycles

Automated routing and real-time notifications reduce delays at every stage. Invoices are processed in days—not weeks—helping companies meet deadlines and avoid late fees.

2. Improved Accuracy and Fewer Errors

Built-in validation rules and PO matching minimise human error, prevent duplicate payments, and ensure invoice data is always accurate before approval.

3. Increased Visibility and Transparency

With centralised dashboards and audit trails, finance teams gain full visibility into the status of each invoice—who approved it, when, and why.

4. Enhanced Compliance and Audit Readiness

Structured workflows ensure that invoices follow internal policies and external regulatory requirements. Every step is logged, making audits faster and easier.

5. Stronger Supplier Relationships

Timely payments signal reliability. Vendors are more likely to prioritise and offer favourable terms to companies that process invoices without delays.

6. Cost Savings

Automation reduces labour-intensive tasks, lowers administrative costs, and enables capture of early payment discounts—positively impacting the bottom line.

7. Scalable Financial Operations

As invoice volumes grow, automated workflows scale effortlessly—without the need to hire additional finance staff or expand overhead processes.

Key Components of Invoice Approval Workflows

A well-designed invoice approval workflow is built on essential components that ensure speed, accuracy, and control. These elements work together to streamline how invoices are processed from receipt to payment.

1. Invoice Capture

The process begins with collecting invoices—either through email, scanned documents, or digital uploads. Advanced systems use OCR (Optical Character Recognition) to extract data automatically from invoices, eliminating manual entry.

2. Data Validation

Before routing, the system checks for completeness, duplicates, and errors. Validation rules ensure all required fields—such as PO number, vendor ID, tax details—are present and correct.

3. Purchase Order (PO) Matching

Invoices are matched against purchase orders and goods received notes (GRNs) to verify that billed items were ordered and delivered as expected. This can involve two-way or three-way matching, depending on the policy.

4. Approval Routing Logic

Based on predefined rules (e.g., department, invoice value, urgency), invoices are automatically routed to the right approvers. Conditional workflows ensure escalations or multiple sign-offs when required.

5. Notifications and Reminders

Automated alerts notify approvers when action is needed, and reminders are triggered for pending or overdue approvals—helping maintain timely processing.

6. Exception Handling

When discrepancies arise (e.g., price mismatch, missing PO), the system flags the invoice for manual intervention or rerouting, ensuring resolution before payment.

7. Audit Trail and Reporting

Every action in the workflow is logged with a timestamp. This provides traceability for compliance audits and enables performance monitoring through built-in analytics and reports.

Key Features of Invoice Approval Workflow Software

To build an efficient and scalable invoice processing system, businesses need software equipped with essential features that support automation, control, and real-time visibility. Below is a list of core features to look for when evaluating invoice approval workflow solutions:

| Feature | Description |

| Visual Workflow Builder | Allows finance teams to design custom approval paths using drag-and-drop tools—no coding needed. Approvals can be configured based on invoice value, department, or urgency. |

| Automated PO and GRN Matching | Performs two-way or three-way matching between invoices, purchase orders, and goods received notes. This ensures that only verified invoices proceed to payment. |

| Role-Based Access Control | Enables secure access to workflow actions based on user roles, ensuring that only authorised personnel can view, edit, or approve invoices. |

| Integration with ERP and Accounting Systems | Seamlessly connects with platforms like SAP, QuickBooks, Oracle, and Netsuite to sync data in real time and eliminate duplicate entries. |

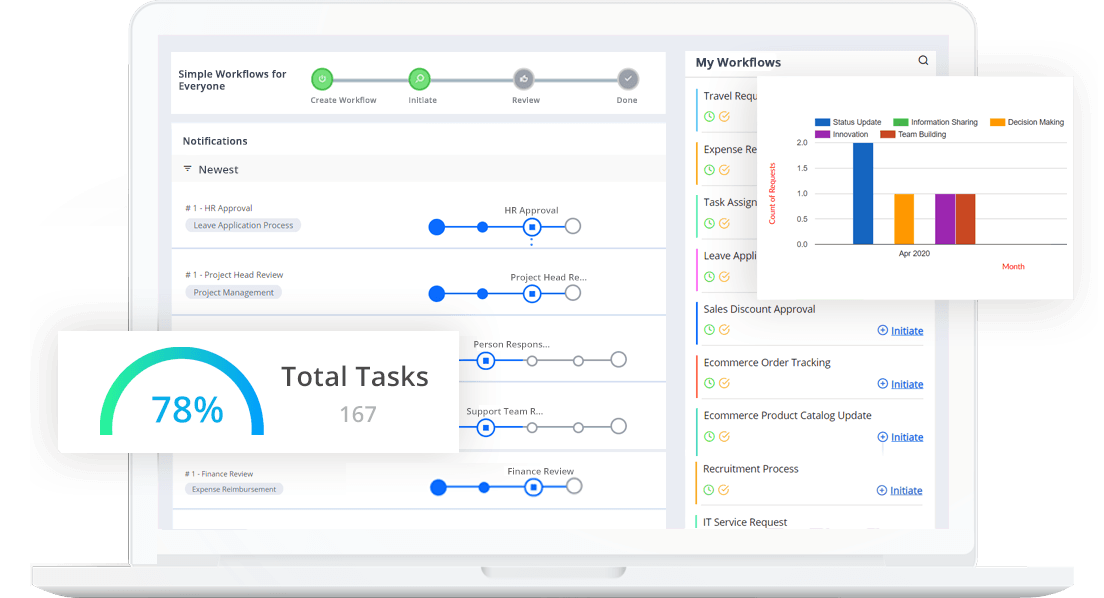

| Centralized Dashboard | Provides real-time visibility into invoice status, pending approvals, and exceptions. Finance managers can track KPIs and identify bottlenecks quickly. |

| Customizable Notifications and Escalations | Sends automated email or in-app alerts when approvals are due or overdue. Escalations ensure urgent invoices aren’t held up in the queue. |

| Mobile Accessibility | Supports invoice approvals on smartphones or tablets—ideal for managers and field teams who need to authorise payments on the go. |

| Audit Trail and Compliance Logging | Automatically records every action taken on each invoice, including timestamps, user actions, and comments—supporting internal audits and regulatory compliance. |

Common Mistakes to Avoid in Invoice Approval Automation

Implementing invoice automation doesn’t guarantee success unless the workflows are thoughtfully designed and user adoption is prioritised. Many businesses fall into traps that end up creating more confusion instead of efficiency. Here are the most common mistakes to watch out for—and how to avoid them:

Overcomplicating the Workflow

While it’s important to enforce control and accountability, adding too many approval layers can slow down the process significantly. When an invoice must pass through multiple unnecessary checkpoints, it creates bottlenecks, increases processing time, and defeats the purpose of automation. Keep the routing logic simple and role-specific—only escalate when thresholds are met.

Poor Change Management

A new system, no matter how efficient, is only as effective as its users. If employees are not trained on how to use the platform or understand the rationale behind the change, they may resist adoption or revert to familiar manual processes. Clear communication, hands-on training, and stakeholder involvement are essential to driving successful implementation.

Lack of Customisation

Organisations often differ in how departments, approval chains, and compliance requirements are structured. Relying on a rigid, one-size-fits-all workflow leads to inefficiencies when teams have to work around system limitations. Instead, choose a solution that allows flexible configurations—so workflows can be tailored to department needs, geographic regulations, or invoice types

Best Practices for Efficient Invoice Approval Workflows

Let’s explore some of the most effective practices to design an efficient, automated invoice approval workflow:

1. Standardise Invoice Formats

Ensure all vendors submit invoices in a consistent digital format (PDF, XML, etc.) to streamline data capture and validation.

2. Use Pre-Defined Approval Hierarchies

Define roles and escalation paths based on invoice type, amount, and department to avoid confusion and prevent bottlenecks.

3. Match Invoices with POs and Receipts

Automate 2-way or 3-way matching to confirm that the invoice aligns with the original purchase order and delivery receipts.

4. Set Up Automated Reminders

Send automated email or system notifications to approvers to keep invoice approvals moving without manual follow-ups.

5. Monitor KPIs

Track metrics like approval time, payment delays, and exceptions to identify process inefficiencies and opportunities for improvement.

These practices form the foundation of effective invoice approval workflow software that ensures compliance, accountability, and speed.

What would you like to do next?

Automate your workflows with our Cflow experts.